Billionaire Nelson Peltz Is Fighting to Join Walt Disney Co. Board — What's His Net Worth?

Nelson Peltz is a businessman and founder partner of Trian Fund Management, worth billions. What's his net worth, and how did he make money?

Jan. 12 2023, Updated 1:26 p.m. ET

Long before his daughter Nicola Peltz made headlines for marrying Brooklyn Beckham in April 2022, Nelson Peltz has been making headlines for himself as a billionaire businessman and investor.

While he isn't as famous as his daughter's in-laws, David and Victoria Beckham, his net worth definitely matches up.

So, how did Peltz make his money and build his business empire? Keep reading to find out.

Nelson Peltz grew his impressive net worth thanks to several major investments.

Claudia Peltz, Nelson Peltz, Wendy Deng, and Rupert Murdoch.

Peltz, born to Jewish parents Claire and Maurice Peltz in 1942, grew up in Brooklyn and attended Horace Mann School.

After graduating, Peltz went on to pursue his undergraduate education at the University of Pennsylvania in 1960 but dropped out in 1963 and started working with his family.

"I took a job in the family food business — we sold fresh produce and frozen food in New York — driving a truck for two weeks for a hundred bucks a week," stated Peltz.

After a few years, Peltz turned the family business into a multimillion-dollar corporation, acquiring the beverage brand Snapple in 1997. He sold Snapple and other beverage brands to Cadbury Schweppes in 2000.

In 2005, Peltz and his partners founded Trian Fund Management, an investment company. It invested in major names such as Heinz, Kraft, and Wendy's.

Nelson Peltz

Founding Partner, Trian Fund Management

Net worth: $1.4B

Nelson Peltz is a billionaire, investor, and co-founder of Trian Fund Management, a New York-based investment company. Peltz is also chairman of Wendy's, Sysco, and Madison Square Garden Entertainment.

Birthdate: June 24, 1942

Birthplace: New York City

Spouse: Claudia Heffner

Children: Brad, Will, Nicola

Education: Dropped out of the Wharton School of the University of Pennsylvania

According to Forbes, Trian currently has $8.5 billion in assets under management, and Peltz himself is worth $1.4 billion.

To put that into comparison, the Beckhams are worth $450 million combined.

The Peltz-Beckham prenup was likely the "mother of all prenups."

The nature of Nicola's prenup with Brooklyn Beckham has drawn a lot of attention. According to The Daily Mail, specific details of the prenup weren't released, but it was reported that the prenup focused on protecting the Peltz family's wealth.

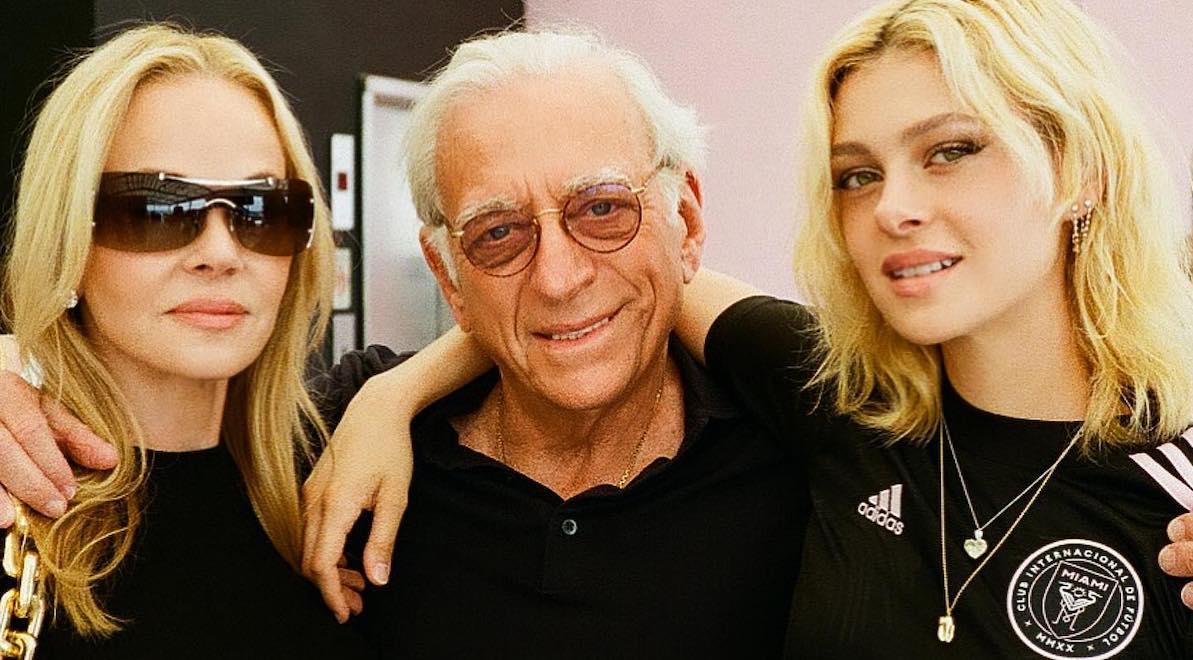

Nicola (R) with her parents Nelson and Claudia Heffner Peltz.

"While the money may be family money and not necessarily titled in Brooklyn or Nicola’s name, without a prenuptial agreement, many issues can arise," attorney Adam Citron, a partner at Davidoff Hutcher & Citron, who doesn't represent Peltz, told Market Realist. "For example, a Court will look at the lifestyle of a marriage in determining support and may input income to a party if it is determined that throughout the marriage family funds were used on a regular and consistent basis to support the lifestyle of the marriage."

He went on add that prenups are extremely common when it comes to this level of wealth.

"Most ultra-wealthy people have lawyers with whom they regularly work, and given the amount of money at stake, are likely to advise their clients to get prenuptial agreements as a matter of course," Citron explained. "I would expect that both parties waived maintenance and that their separate property would remain their separate property."

Nelson Peltz is now fighting for a spot on the Walt Disney Co. board.

Shortly after Disney made the decision to bring former CEO Bob Iger out of retirement, Peltz is attempting to join Disney’s board.

According to AP, Peltz believes he should be elected to Disney’s board "because of his prior experience turning around companies to improve performance and increase long-term shareholder value."

In a regulatory filing by Peltz’s Trian Group, it was revealed that he is seeking a one-year term.

"The Trian Group believes that Disney’s recent performance reflects the hard truth that it is a company in crisis with many challenges weighing on investor sentiment," the filing stated.