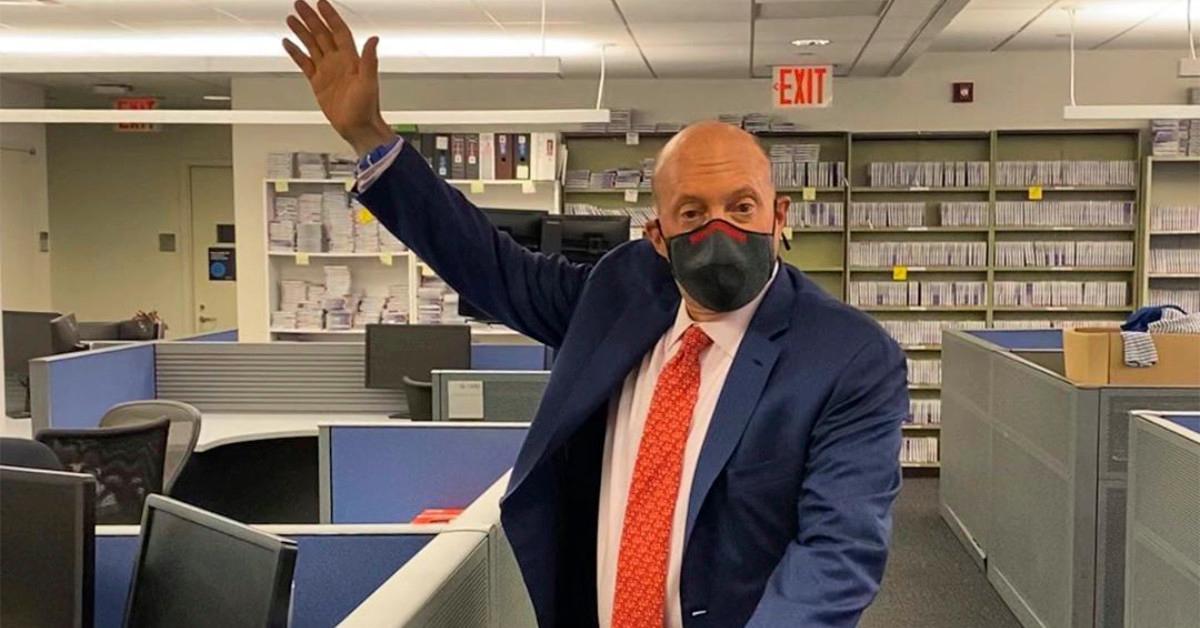

Jim Cramer Says 6 Cloud Stocks Pass His New Rule of 40

Jim Cramer introduced his Rule of 40 in 2019 to identify risky cloud stocks. After he revised the rule in 2020, only six cloud stocks pass the test.

Oct. 5 2020, Updated 2:41 p.m. ET

When Jim Cramer introduced his Rule of 40 in September 2019, cloud equities had just taken double-digit hits. The Mad Money host said it was time for investors to be “more selective” in the software-as-a-service stocks in their portfolios.

“When you make these kinds of decisions, you need to be ruthlessly logical, not emotional,” Cramer said at the time. “We’re in triage mode, and that means we need to be as objective as possible.”

In June, Cramer told Mad Money viewers that he was updating the quick-and-dirty rule to include valuations after tech companies posted “extraordinary” results during “a very difficult period for the economy.”

What is Jim Cramer’s Rule of 40?

When Cramer introduced the Rule of 40 in September 2019, he said that a company’s revenue growth plus its profit margins — defined as earnings before interest, taxes, depreciation, and amortization, or EBITDA — should be greater than 40 percent.

A company with 30 percent revenue growth and a 20 percent profit margin would pass the test, as would one with 70 percent revenue growth and -20 percent profit margin. However, a company with a 50 percent growth and -15 percent profit margin wouldn't pass the test.

“I like this rule of 40 because it recognizes that there are two ways to win,” Cramer said at the time. “The healthiest cloud stocks are either growing very rapidly and losing money or their growth is slowing, but they’ve got increasingly strong earnings.”

As another filter, he recommended looking at valuations and avoiding stocks that trade for above 10 times their sales estimates. “We’re going to run our whole cloud universe through these two filters — one is for fundamentals, one is for valuation,” he said on his show. “Anything that passes both filters, well then you’ve got my blessing buy down here after the big sell-off.”

By June 2020, Cramer had incorporated valuation into the original rule. “The problem here is valuation: The Rule of 40 doesn’t tell you anything about that. So, what if we created a new metric … by taking the Rule of 40 score and dividing it by the price-to-sales multiple,” he said on Mad Money. “It’s a subjective standard, but I kinda like it.”

Now, there's the modified Rule of 40. A company’s revenue growth plus its EBITDA should be at least five times the size of its price-to-sales multiple.

Which cloud stocks does Jim Cramer recommend?

In June, Cramer identified studied 50 cloud stocks. He found 17 cloud stocks that passed his original Rule of 40. The stocks are Adobe, Chegg, Salesforce.com, VMware, Zoom Video, Livongo Health, Crowdstrike, Veeva Systems, Datadog, ServiceNow, Atlassian, DocuSign, Fastly, Dynatrace, Zscaler, Dropbox, and Wix.com.

Among those 17 stocks, only six passed the modified Rule of 40 — VMware, Dropbox, Salesforce, Chegg, Adobe, and Livongo.

“Now, I think this is a decent list if you’re worried about valuations and don’t want to chase the red-hot stay-at-home stocks,” he said on Mad Money.