YOLO Gives Marijuana Investors Built-In Diversity and Stellar Returns

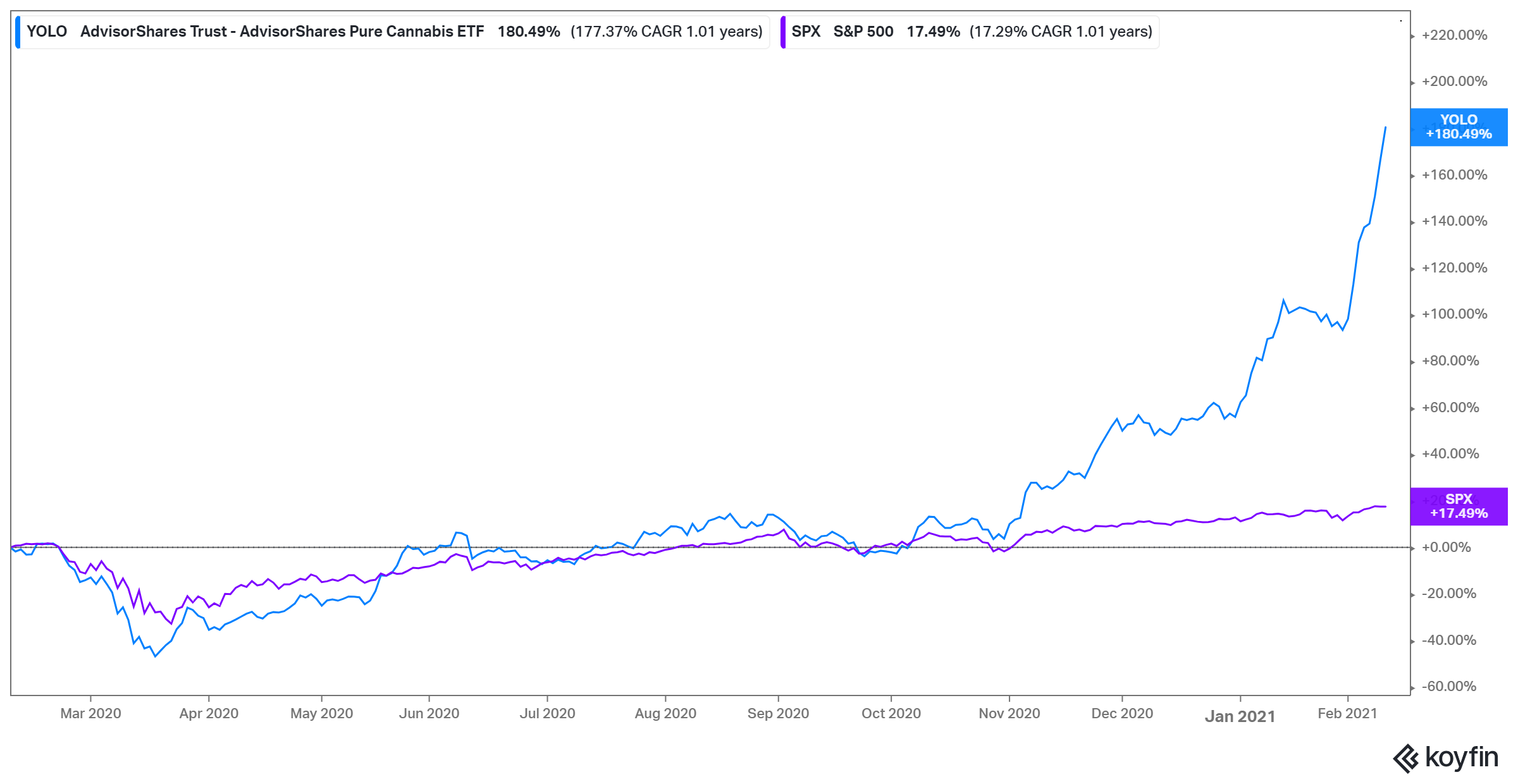

The YOLO ETF invests in global marijuana stocks and distributes dividends to shareholders. YOLO has better returns than the S&P 500.

Feb. 11 2021, Updated 11:57 a.m. ET

The AdvisorShares Pure Cannabis ETF (YOLO) is an actively managed fund that mainly invests in marijuana stocks. While the fund hasn’t restricted itself to a particular region, its portfolio leans more toward the U.S. and Canada. About 62 percent of the YOLO marijuana ETF portfolio is in U.S. stocks and about 30 percent is in Canadian stocks.

YOLO’s top five marijuana stock holdings by portfolio weight are Village Farms International (VFF), GW Pharmaceuticals (GWPH), Aphria (APHA), and Canopy Growth (CGC), and Innovative Industrial Properties (IIPR). Aphria is merging with Tilray to form a giant global marijuana company. VFF is YOLO's largest bet and accounts for 15.5 percent of the fund’s portfolio. VFF stock has more than quadrupled in the past 12 months.

Is YOLO a good marijuana ETF?

YOLO has a net expense ratio of 0.75 percent, which is fair for an actively managed fund that seeks to deliver better returns than index funds. Investors have seen returns of more than 110 percent on YOLO ETF stock in the past three months — compared to 16 percent for the stock market benchmark S&P 500.

Usually, YOLO distributes dividends four times a year. It last paid a dividend of $0.0373 in December 2020. YOLO's total dividend distribution in 2020 was more than $0.34 per share. The fund’s next dividend distribution date is March 31, 2021.

Investing in YOLO

You can invest in the marijuana industry in a variety of ways. You could pick individual stocks for your portfolio. However, it can be difficult for a retail investor trying to build a diversified marijuana stock portfolio with limited capital or time to research the stocks.

Funds like YOLO solve that problem. First, they give investors broad exposure to the industry at a single point. Since ETF portfolios are naturally diversified, they minimize market volatility risks. Marijuana stocks can be highly volatile with swings of more than 20 percent in a single day. In addition to built-in portfolio diversity, YOLO has a track record of delivering market-beating returns. Also, the ETF's expense ratio is reasonable.

Top marijuana ETFs

Marijuana ETFs are becoming popular with retail investors seeking exposure to the legal marijuana industry. Besides YOLO, the other top marijuana ETFs right now are:

- the Global X Cannabis ETF (POTX)

- the Amplify Seymour Cannabis ETF (CNBS)

- the Cannabis ETF (THCX)

The Global X Cannabis ETF mainly invests in marijuana stocks and it has global coverage. The fund has an expense ratio of 0.50 percent and has returned 135 percent in the past three months.

Similar to POTX, the Amplify Seymour Cannabis ETF also invests in global marijuana stocks. CNBS has an expense ratio of 0.75 percent and sports 130 percent return on the stock in the past three months.

The Cannabis ETF (THCX) invests in global marijuana stocks. The fund has an expense ratio of 0.70 percent and its stock has delivered returns of more than 128 percent in the past three months.

Marijuana stocks are a good investment

The marijuana industry has bright prospects. The global legal marijuana market is on track to reach $74 billion by 2027 from $17.7 billion in 2019. Democrats have usually been supportive of the marijuana enterprise. With the party controlling both the White House and Congress, marijuana businesses should do better in the next four years.

In an uncertain regulatory environment, marijuana stocks have largely been speculative bets among retail investors. However, institutional dollars are starting to flow into marijuana stocks as legalization gains momentum around the world. The involvement of long-term institutional investors brings legitimacy and should provide some price stability.

For those with small capital or not enough time to study individual stocks for good picks, investing through marijuana ETFs could be a better option to gain exposure to this lucrative industry.