How to Trade Skype Under Its Parent Company

Investing in Skype has to be done indirectly, but that doesn't mean you can't trade this parent-owned brand. How can investors get access to Skype?

Feb. 17 2021, Published 11:17 a.m. ET

Zoom might have received most of the press in 2020 (with its stock rising 401.37 percent over the course of the year), but it isn't the only video communication platform out there. Skype is eight years older and 300 million monthly active users are evidence that it's still a big name in the video call game.

Despite that, Skype doesn't have its own stock on the market. Retail investors can find the stock through Microsoft, which owns Skype—among other subsidiaries.

Skype's valuation

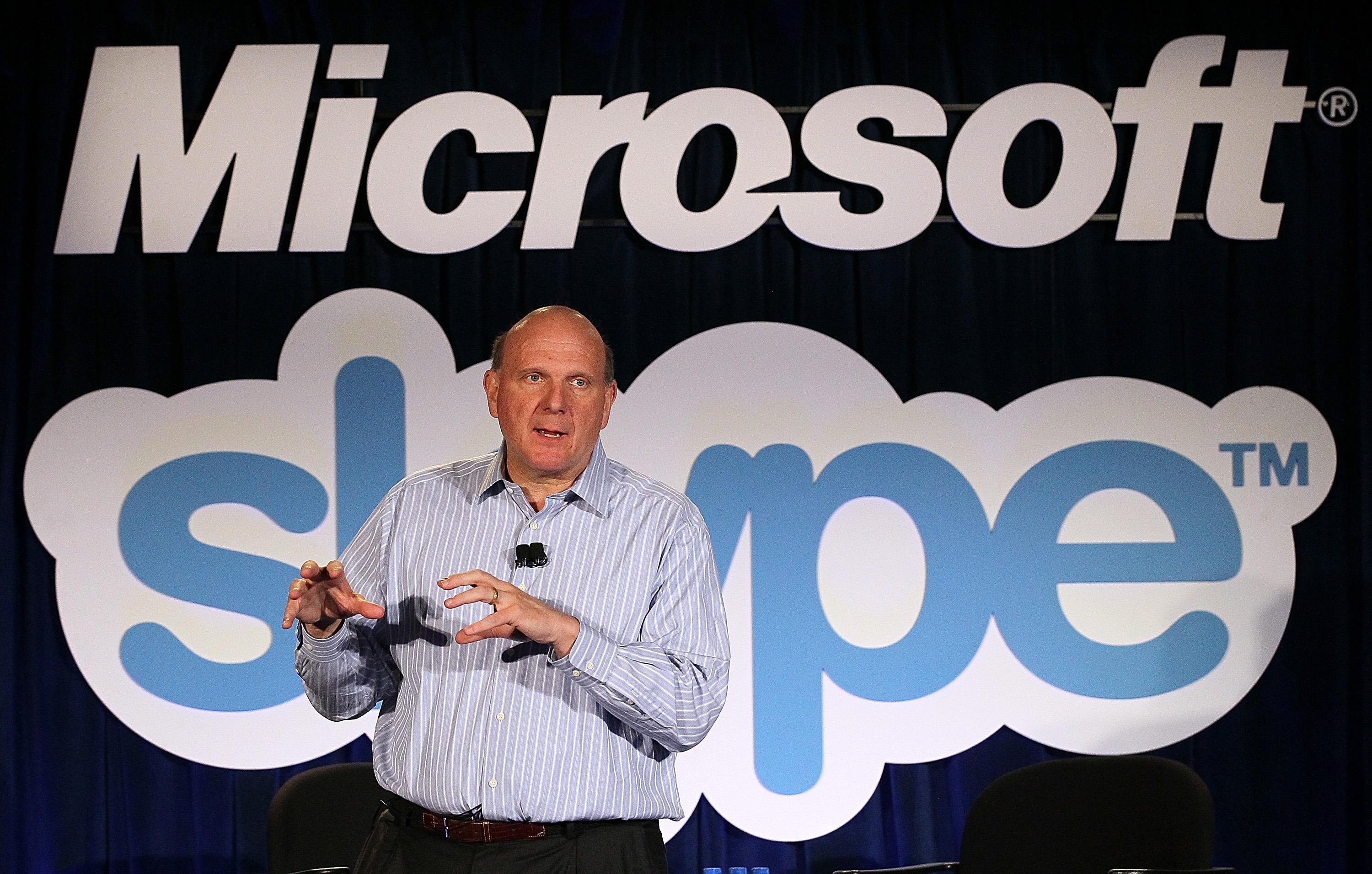

Microsoft (NASDAQ: MSFT) acquired Skype in 2011 for a total of $8.5 billion. It has been a decade since the deal went through. Skype's current valuation is interesting for investors whether or not they want a stake in the company.

After 70 percent user growth in March 2020 alone and more than $2 billion in sales since 2013, it's almost certain that Microsoft's initial investment has come full circle (and then some).

Skype's parent company is publicly traded

Since Skype isn't publicly traded on its own, Microsoft's publicly raised capital doesn't go directly to Skype. There's the Microsoft brand itself, but there's also a lineup of companies owned by Microsoft.

The companies include LinkedIn Corp., which Microsoft purchased in December 2016 for $27 billion. Microsoft also acquired GitHub in 2018 for $7.5 billion and Mojang in 2014 for $2.5 billion. The company bought aQuantive in 2007 for $6.3 billion.

One of Skype's biggest competitors is familial

In March 2017, Microsoft launched Teams. With a more business-to-business mindset than other video communication platforms, Microsoft Teams does its own thing. However, there isn't any denying that it's a Skype competitor to some degree.

Of course, there's also Zoom, which the COVID-19 pandemic thrust into the limelight. Even security issues haven't stalled its popularity by anything more than a margin.

Unfortunately for Skype, LinkedIn recently announced video integration on its direct messaging function using Microsoft Teams and Zoom.

What happened to the Skype IPO in 2010?

In 2010, Skype announced an IPO. At the time, the offering was projected to raise as much as $100 million. However, with Microsoft finalizing the Skype purchase just seven months later, it seems like the parent company finagled its way into Skype before it had a chance to go public. The $8.5 billion offer was clearly enough for Skype executives to bail on their shot at the public market.

Invest in Skype through MSFT

Microsoft is a blue-chip stock that courts institutional and retail investors alike. Mutual fund holders account for 40.44 percent of the company's shares.

In pre-market hours on Feb. 17, Microsoft was trading at $243.70 per share. Quarterly dividends are enough to court investors as well as a five-year return of 370.28 percent.

Microsoft has been public for nearly four decades (since 1986) when it debuted at $21 per share. Currently, Skype and other companies on the Microsoft roster help propel it, even when their own earnings stutter.