Is M1 Finance Really the Better Way to Invest? Get the Facts on This Startup

Is M1 Finance safe? Is it a better way to invest? Get to know this Chicago-based fintech startup.

Sept. 30 2020, Updated 3:00 p.m. ET

Chicago-based startup M1 Finance announced on Sept. 9 that it had surpassed $2 billion in AUM (assets under management) on its platform, the milestone coming just six months after M1 cleared the $1 billion mark. In its press release, the company claimed to have hit the $1 billion and $2 billion AUM thresholds faster and with less funding than competing online brokers Wealthfront, Betterment, and Acorns. But is M1 Finance really the better way to invest?

Reviewers certainly seem impressed. Investopedia gave M1 Finance 4.1 out of 5 stars and ranked M1 first in its 2019 Best Robo-Advisor, Best For Socially Responsible Investors, and Best For Sophisticated Investors categories. CreditDonkey gave the platform 4.5 out of 5 stars, saying M1 “stands out from other robo-advisors by letting [you] create and customize your own portfolio.” And TechRadar gave M1 the same score, saying the tool is “best fit for the starters.” Keep reading for more details about this upstart fintech company.

Who founded M1 Finance?

Brian Barnes, the son of a former chairman and CEO of Sara Lee and a former treasurer at PepsiCo, founded M1 Finance in 2015. “Ever since buying my first stock at 10, investing became a hobby and a passion,” he blogged two years later. “I loved approaching potential investments as a puzzle, taking in current facts to make predictions about the future. Over time, I earned—and lost—real money … However, upon landing my first real job after college, I discovered that while I loved investing, I absolutely hated the process. The reason for my frustration was clear—there were no truly good tools available to manage money.”

Barnes wrote that M1 wants to create the best financial product available, adding, “The story of M1 Finance is one of frustration with the status quo and the belief that I could create the finance company of the future by taking a different approach: Rethink personal financial management to design an entirely new set of tools and services, built with the latest technologies.”

Is M1 Finance safe?

M1 is registered with the SEC (Securities and Exchange Commission) and a member of FINRA (Financial Industry Regulatory Authority) and the SIPC (Securities Investor Protection Corporation).

“SIPC protection is up to $500,000 which includes a $250,000 limit for cash,” M1’s website explains. “SIPC does not protect you for any decline in the value of your securities. Our clearing firm has also purchased supplemental insurance in the event that SIPC limits are exhausted.” In addition, M1 Spend and M1 Plus accounts are insured up to $250,000 through FDIC and further insured through Lincoln Savings Bank, the company adds.

In terms of security, M1 says its data is secured with military-grade 4096-bit encryption, and customers can use two-factor authentication for added protection. M1 is not yet accredited with the Better Business Bureau, but it does have an A+ BBB Rating. (For what it’s worth, however, the BBB customer review average for M1 is only 1.5 out of 5 stars.)

Does M1 Finance have fees?

M1’s platform has been free to use since December 2017, with Barnes blogging at the time that going free is part of the company’s mission “to remove barriers for better investing.”

The company does charge miscellaneous fees, though, including a $5 fee for every 50 pages of paper statements, a $20 account inactivity fee, a $100 fee for outgoing direct account transfers, a $20 fee for mutual fund sales, as well as regulatory fees and miscellaneous bank fees. Refer to the M1 website for a full list of miscellaneous fees.

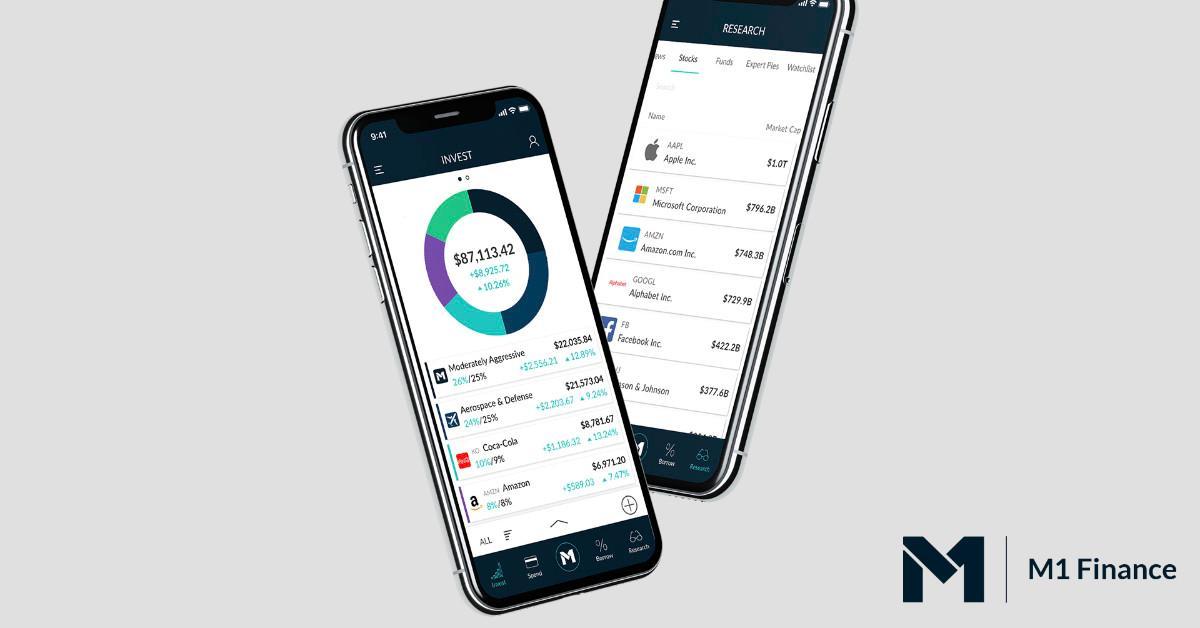

What makes M1 Finance different from other online brokers?

M1 described its special sauce, so to speak, in an April 2020 article. “Traditional online brokerages are oriented towards trading and require manual inputs for every trade,” the company said. “Every transaction requires the user to specify the security, whether to buy or sell, the quantity of shares to transact, order type, and the time of order entry. This makes managing a portfolio difficult, time-consuming, and expensive.”

M1, on the other hand, “allows you to easily manage a desired portfolio. You can customize and organize a portfolio, and all trading is automatically done for you based on certain events. A deposit, withdrawal, or rebalance can all be done with a click of a button.”