IRS Gets Funding to Hunt for Unreported Income, Might Audit Venmo

Biden announced additional funding to the IRS to investigate unreported income on services like Venmo. Will the IRS audit Venmo?

April 30 2021, Published 3:08 p.m. ET

A segment of President Biden’s $1.8 trillion American Families Plan includes $80 billion towards the IRS to crack down on tax compliance in the hopes of generating additional income over the next 10 years to pay back a portion of the plan's hefty price tag. A primary focus is unreported income on peer-to-peer services like Venmo and PayPal.

Unreported income is something that the IRS has struggled to get a grasp on. The number of IRS enforcement personnel has dropped by 17,436 since 2010. IRS Commissioner Charles Rettig estimates that the amount could be as much as $1 trillion per year. He told the Senate Finance Committee earlier this month, "We do get out-gunned." With more opportunities for Americans to dodge their tax responsibilities with gig economy workers and cryptocurrencies, that number could be even higher.

Biden will call on banks to help find unreported income.

An element to Biden’s American Families Plan adds reporting requirements for banks aimed at identifying unreported income. While the IRS can obtain banking information through audits, the banks would be required to report account inflows and outflows to the IRS. Also, these requirements would extend to peer-to-peer payment apps like Venmo. According to those close to the plan, individuals and businesses won’t be required to report any additional information. Banks and other financial institutions currently report interest, dividend, and investment income.

“This information will help improve audit selection so it can better target its enforcement activity on the most suspect evaders, avoiding unnecessary audits of ordinary taxpayers,” the Treasury Department said in a statement.

What does this mean for Venmo account holders?

While the new provisions won’t change the tax responsibility of those who use services like Venmo and PayPal to transfer money to friends and family, it would create added bureaucracy for those companies. Not just limited to financial institutions, the IRS has the authority under the plan to request account inflow and outflow information from these services.

The added oversight won’t necessarily show the IRS that an account holder is hiding income. Also, it won't automatically convict account holders of any wrongdoing. It will help the IRS identify any red flags and help the department pinpoint necessary audits—something the department has wasted a tremendous amount of money on in the past.

Biden’s aims to get the wealthiest Americans to pay their fair share.

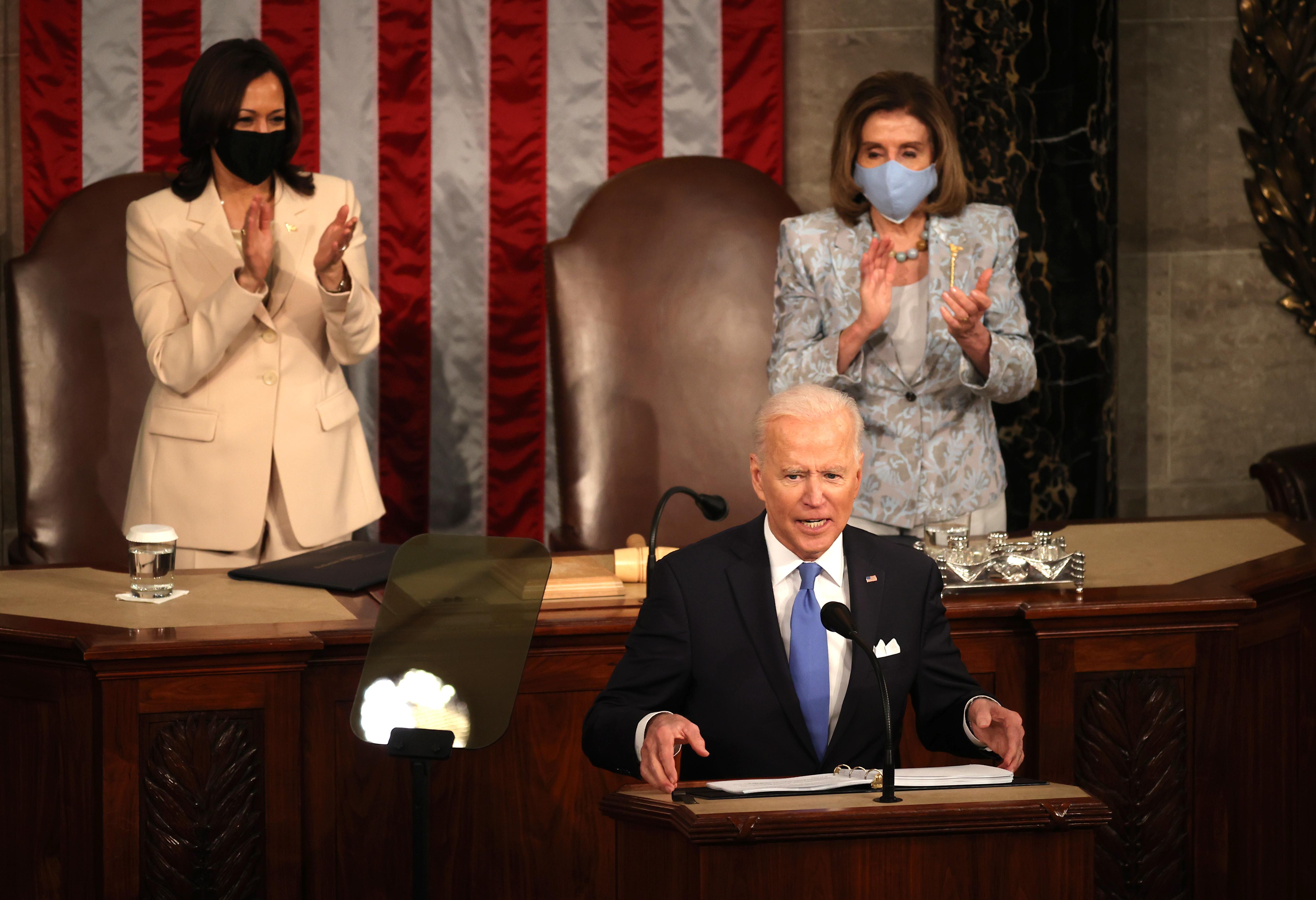

During his address to a joint session of Congress on April 28, Biden reiterated his goal is to garner the majority of the government’s funding from the top percent. "The IRS will crackdown on millionaires and billionaires who cheat on their taxes," Biden said, adding that he’s “not out to punish anyone.”

The idea of getting the wealthiest Americans and corporations to pay up is a noble goal. Biden has already established a plan to incentivize corporations that don’t offshore their profits and reward businesses that manufacture here in the U.S.

Expanding the IRS’s ability to peek into peer-to-peer payment services might have undue consequences and result in headaches for ordinary Americans. While everyone should be contributing their fair share in taxes, tackling unreported Venmo income would be a drop in the bucket compared to the missed revenue from corporate tax workarounds.