If You Earn Under a Certain Amount, You Might Not Owe Taxes

No one likes having to pay taxes. Thankfully, there are many ways to help lower your taxable income no matter what you do for a living.

March 11 2021, Published 9:38 a.m. ET

No one likes having to pay taxes, especially when you don't need to. Thankfully, there are many ways to help lower your taxable income no matter what you do for a living. While filing taxes used to be a bit more complicated in the U.S., where there was a difference between people under the age of 65 and those older, now everything has been simplified and streamlined.

Of course, this varies from country to country, so you'll need to know how your own nations' tax code works and how it applies to you. However, in the U.S., there are certain conditions under which you don't need to pay any tax at all.

How much you make tax-free each year

The exact amount you have to make to not have to pay tax depends on a few things. Mainly, it depends on your gross income and marital status. If you made less than $9,875, you don't have to pay taxes. If you’re the head of your household but you aren’t filing jointly with a spouse, then the figure jumps to $14,100.

If you're married, this changes things slightly. If you file your income taxes together, your maximum gross income could be $19,751, although it's slightly different if the two of you want to file your taxes separately. For the most part, the maximum income that you can make without paying any taxes is going to be between $9,875 to $19,751. Above that, you’re going to start paying some of your income towards the IRS.

What if I own a business?

If you operate some sort of small business or if you are a freelancer, you need to file your taxes no matter how much you made. For businesses, you have to pay taxes on your income, regardless of whether you made any profit for that year. However, this varies depending on how your business is structured. If you're a sole proprietorship, you could file your business income on your personal tax return. It's a similar situation with freelancers, where you need to file your taxes if you made more than $400 in self-employed income that year.

How to lower your taxable income

There are a few ways to lower your taxable income and help you pay fewer taxes. One way is to set up and contribute to a retirement savings account, like an IRA or a 401(k). Also, contributing to other specific bank account types, like a Health Savings Account, is another way to lower your taxable income.

If you operate a business or have a sole proprietorship, claiming business expenses can help lower your income. This could be the cost of materials and supplies or it could be any marketing expenses you require. Even a portion of your phone or internet bill that you use for work could be filed as a business-related expense.

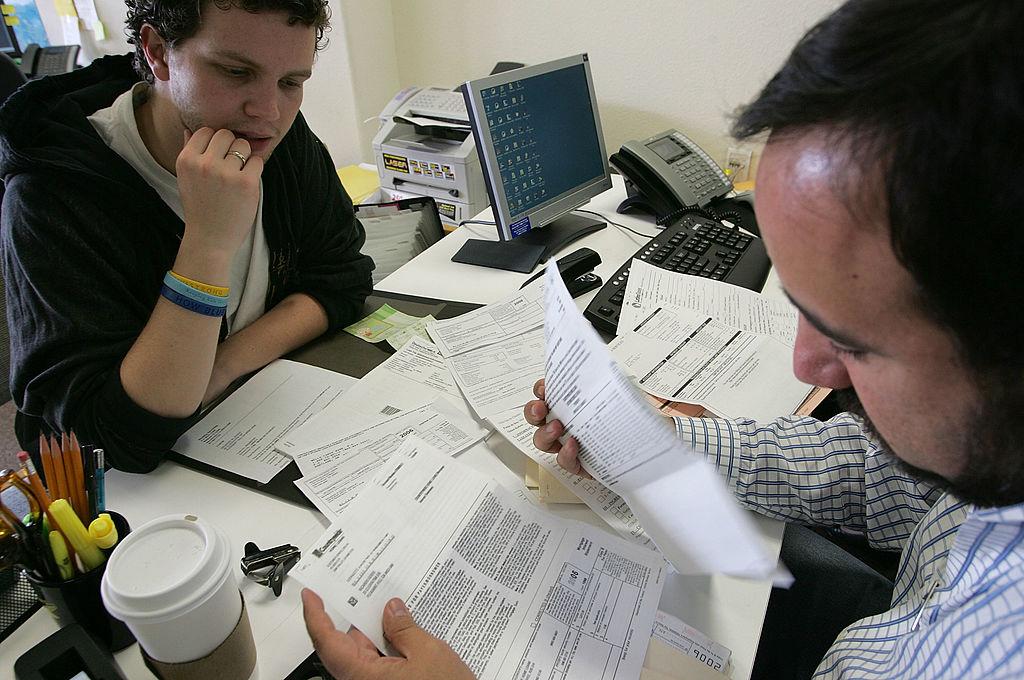

Finally, it might be worth paying for tax software or a tax professional if your situation is complex enough to warrant their expertise. There's only so much you can do just from your own research. An experienced accountant can tell you what's the best way to pay fewer taxes, especially if you're in a higher income bracket.