Second Draw PPP Loan—Approval Timeline, Explained

If you have applied for the second draw of your PPP loan, here's what to expect, including how long funding will take.

June 11 2021, Published 12:23 p.m. ET

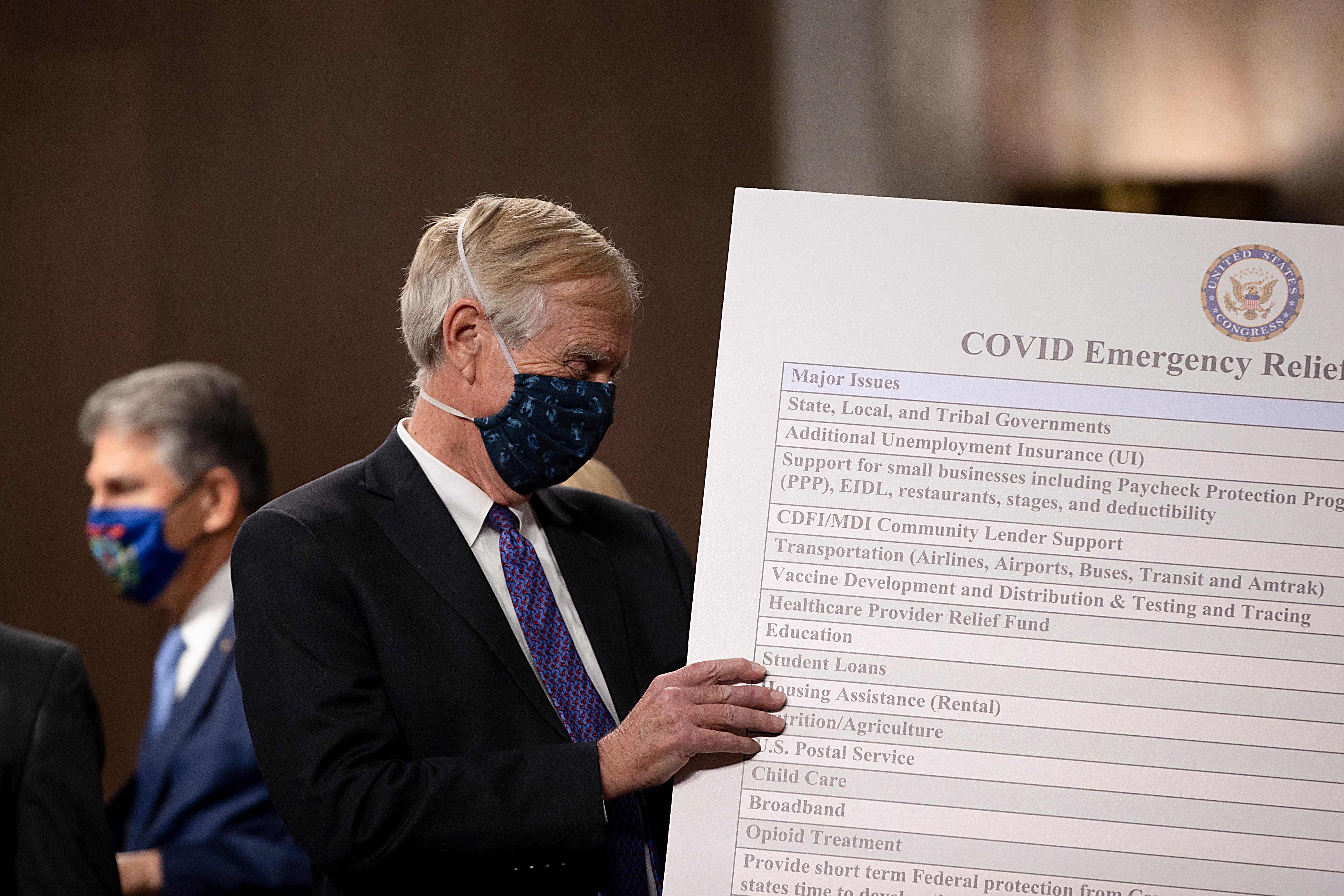

For small businesses across the nation, the PPP (Paycheck Protection Program) was a lifesaver. In 2021, independent contractors and single-member LLCs were added to the mix of eligible businesses, which increased the program's reach. Those who recently applied for the second draw of their PPP loan might be eagerly awaiting their final funding.

How long does it take for the second draw of your PPP loan to get approved? Here are the details.

Provide accurate information for your second PPP loan

If the information in your PPP loan isn't correct, you might experience delays in receiving your funding as a direct deposit to your bank account.

This is especially true for the second draw. According to the application, you're required to show evidence that you have experienced a loss in earnings from 2019–2020 of at least 25 percent. Even if your funding goes through, you might have trouble acquiring loan forgiveness without this. It's smart to check this ahead of time so you aren't left with a sizable loan you have to repay.

Check your bank account to see if the second draw dropped

When you apply for the first draw of your PPP loan, you enter your bank account information so it's ready for a timely direct deposit. You might have noticed during this process that you don't necessarily receive a notification when the money drops into your account. However, you do get a notification that the approval process is complete. Then, you wait for your money and repeatedly check your bank account for updates.

Keep an eye on your linked bank account so that you know when the second draw drops as soon as it happens.

You should see your second PPP loan hit your account after the 10-day approval process.

The SBA (Small Business Administration) manages funding for the PPP loan, although third-party banks and lenders have assisted it throughout the process. According to the SBA, approval of funds should occur within 10 calendar days.

Of course, this defines the approval process. The actual funding of your account process will likely take a few more days depending on whether or not there's a weekend or holiday occurring at the same time. The precise timing also depends on what bank you have and how quickly they fund direct deposits.

Is it too late to apply for a PPP loan and receive funding?

The deadline for the PPP loan program ended on May 31. The government funding for the program ran out a couple of weeks prior to the end date. That means it's too late to start the application process. Any applications already in place will likely be funded, although some people who applied after funds ran out (but before the deadline) might have trouble getting the loan.

The SBA offers additional COVID-19 relief if you're in need of funding but didn't get the PPP loans.