How Yotta, a No-Risk Lottery Savings Account, Works

Yotta Saving's winnings sound too good to be true. How does this FDIC-insured platform work? Is it a good bet for investors?

March 29 2021, Published 3:04 p.m. ET

Consumers know about personal finance gimmicks—but with interest yields remaining low for savings accounts for the foreseeable future, there isn't any harm in seeking an alternative for your liquidity. Yotta Saving is a savings account where members are automatically enrolled in a lottery worth millions. Is Yotta all it's cracked up to be?

Here's how Yotta works and how to know if it's right for you.

With Yotta Saving, you're earning tickets and a chance to win.

In a normal or high-yield savings account, you can count on a marginal monthly interest yield. Right now, those rates are really low since they're in line with the federal interest rate (a low federal interest rate is designed to boost investing and minimize saving).

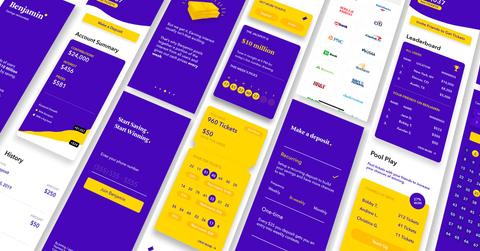

With Yotta, you aren't yielding any interest. Instead, you earn tickets that are aligned with how much you deposit. The tickets make you eligible to win Yotta lotteries.

When a user signs up for a savings account, they link an external bank account and are able to deposit funds. For every $25 they deposit, they get a ticket. Each one of those tickets automatically makes the user eligible for a wide range of lottery winnings available on the Yotta platform. Users pick numbers and their tickets remain eligible for as long as they keep their funds in the account. New lottery winners are revealed every day.

You can get anywhere from $0.10 to $10 million in cash or prizes. Recently, two winners scored a Tesla Model 3. Many users get returns on the smaller end, but it's often still higher than the low-interest yields in savings accounts. Because there isn't a risk of losing money—only the potential to gain—it isn't a bet like a traditional lottery process.

Yotta makes money through bank partnerships.

Yotta partners with external banks to pass funds through to the end-user. The company makes money from interest rates and deposits that their partners pay them. This is interesting because it keeps the consumer out of the obligation and instead only offers them a safe place to keep their money and the potential to win more.

According to Forbes, about 2 percent of Yotta's tickets end up winning something. Most of those tickets win about $0.20.

Yotta funds are FDIC-insured.

Perhaps most importantly, Yotta funds are FDIC-insured up to $250,000 through Evolve Bank and Trust. This means your money is protected in the event that Yotta goes under.

A $13.2 million Series A funding round in January (after a $500,000 pre-seed and $4 million seed round) proves that Yotta is clearly on the up and up. An eventual IPO is still a far-fetched idea. However, with $200 million deposited in 2021, it isn't entirely implausible. Cofounders Adam Moelis (CEO) and Ben Doyle (chief technology officer) are both Forbes 30 Under 30 members who hold a whole lot of potential through their Yotta Saving lottery-winning platform. For users, it seems like a true "no harm, no foul" situation.