How Are Dividends Paid on Robinhood?

Stocks held in a Robinhood account may pay a dividend, and it is important to understand how you receive these payments.

Aug. 14 2020, Updated 1:20 p.m. ET

When you invest in a stock or ETF, the hope is that the asset's value will grow over time and produce a profit. Alongside that growth, you may also receive a dividend when you hold onto some stocks. With many people recently getting into investing for the first time, it is essential to understand how dividends are paid on the popular investment app Robinhood.

What are dividends?

A dividend is a way for companies to share their profits with shareholders. Dividends are usually awarded quarterly and calculated annually. If you own ten shares in a company that pays a $1 annual dividend, you will receive $10 in dividend payments over a year or $2.50 every quarter.

How are dividends paid on Robinhood?

According to Robinhood's website, dividends are automatically paid and require minimal setup on your part. Robinhood explains that, by default, dividend payments are credited as cash to your account. You can use the cash to invest in stocks or withdraw it to a bank account. Alternatively, you can enable Dividend Reinvestment to automatically invest any dividends back into the stock or ETF that paid them.

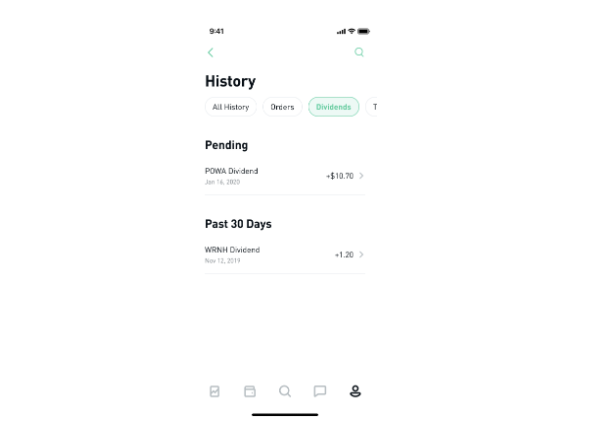

You can view your received and pending dividends on Robinhood by following these instructions:

- Tap the Account icon in the bottom right corner.

- Tap Statements & History.

- Tap Show More.

- Tap Dividends at the top of the screen.

Are dividends taxed?

The short answer is yes, dividends are taxed. If your dividends are paid into a tax-free 401(k) or traditional IRA (individual retirement account), then you will not pay tax on them right away. You will pay tax on them when you start taking distributions. If they are not held in a tax-advantaged account, you will need to treat dividends as income.

The non-qualified dividend tax rates are the same as the regular federal income tax rates. Qualified dividends are taxed at capital gains rates, which are lower. There are differences between qualified and non-qualified dividends.