HR and Payroll Company Gusto Might Go Public in 2022

HR and payroll software company Gusto might go public next year, but there aren't any definitely details yet. Recently, it had a $9.5 billion valuation.

Sept. 27 2021, Published 10:19 a.m. ET

Gusto, a leading HR and payroll software provider, was founded in 2012. As Forbes reported, the company’s CEO Josh Reeves has been clear that Gusto doesn't intend to settle for an acquisition, but will likely go public in the near future.

Although details of the Gusto IPO like the number of shares to be offered, potential price range, and date to be listed publicly aren't known, investors might see Gusto enter the public markets sometime in 2022. The firm recently raised another $175 million in its Series E funding round, which brings it to a hefty valuation ahead of a potential IPO.

Gusto's history as a company

Gusto launched under the name ZenPayroll in 2012 and recently reached the milestone of serving 200,000 companies as its customers. The company’s services provide an all-in-one platform for HR, payroll, and benefits software, and its primary clientele are small and medium-sized businesses.

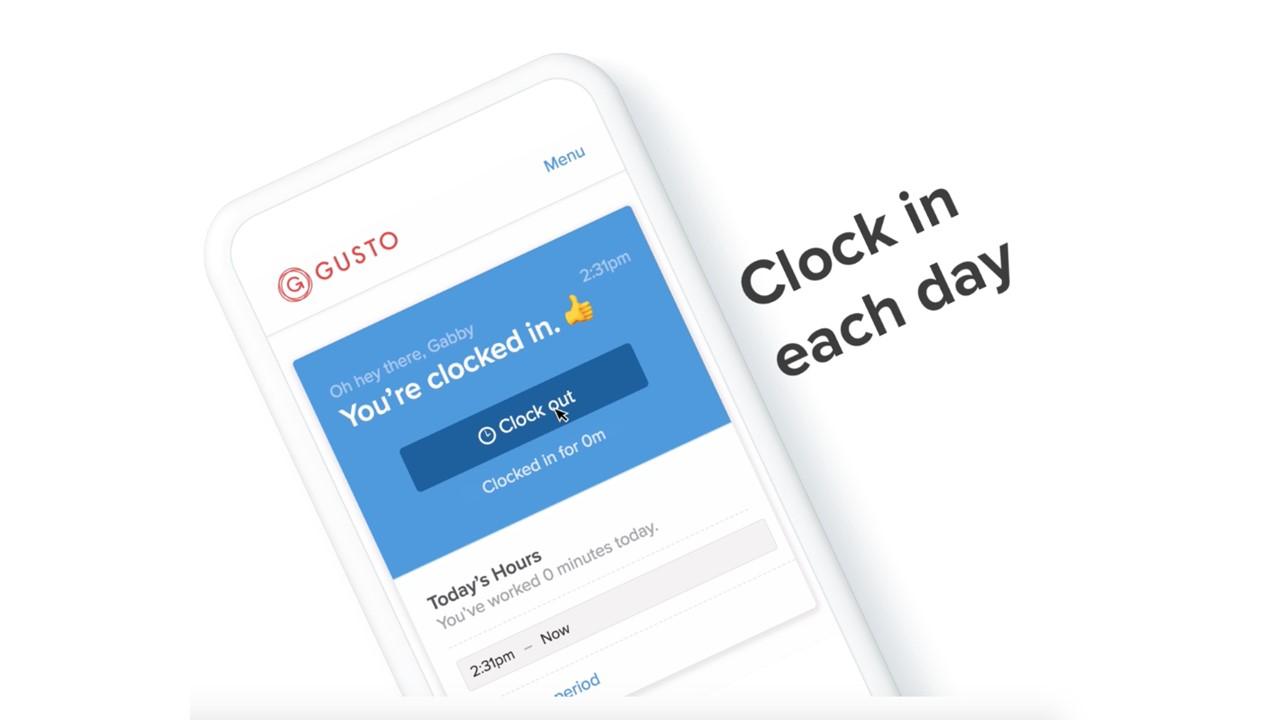

Gusto has tools for payroll including calculations of deductions and filings, direct deposit, and tax forms. It also offers tools for managing employee health benefits, automatic deductions, and 401(k) contributions. Hiring and onboarding tools are available as well.

Gusto made two acquisitions over the summer. The acquisition in June was for Ardius, which is a startup that helps automate tax compliance and focuses on R&D tax credits. In July, the company acquired Symmetry Software, which is a leader in payroll infrastructure technology.

The firm struggled initially during the COVID-19 pandemic. Many of Gusto’s small-business customers asked to defer payments. However, Gusto persevered and added a tool to help disburse PPP loans.

Gusto’s recent funding rounds and valuation

Some of Gusto’s notable funding rounds have included a Series B in 2015 for $90 million, which included investors CapitalG and General Catalyst. A 2018 Series C round for $140 million brought investments from Capital G again, as well as from Dragoneer, T. Rowe Price, and Y Combinator.

In July 2019, the company completed a $200 million funding round in its Series D. The lead investors on that round were Fidelity Management and Generation Investment Management, with additional capital provided by previous investors as well.

August 2021 was Gusto’s Series E funding round of $175 million, which brought its total funding to $691.1 million, according to Crunchbase. Following the completion of this round, Gusto has an approximate valuation of $9.5 billion, which is one of the largest for a non-public HR and payroll software company.

When will Gusto go public with an IPO?

So far it’s early in the IPO planning. Gusto hasn't announced anything definitive. However, as Forbes reported, the company added two new board members and might be looking ahead to a 2022 IPO. Gusto ranked #25 on the Forbes 2021 Cloud 100 List.

Ken Chenault of General Catalyst spoke about Gusto and said, “They have to establish themselves as a critical infrastructure for the SMB economy, much like Shopify has done with its commerce platform.”

Needham & Co. analyst Scott Berg said that the company will need to continue growth by focusing on small and medium businesses even in a saturated market, according to Forbes. As more companies require payroll assistance, Gusto has the potential to grow and merit its nearly $10 billion valuation.