Doximity IPO Leaves Room for Physician Users to Get on Board

Health tech company Doximity filed for an IPO. The offering leaves a large portion of shares for its users to invest in.

June 4 2021, Published 3:38 p.m. ET

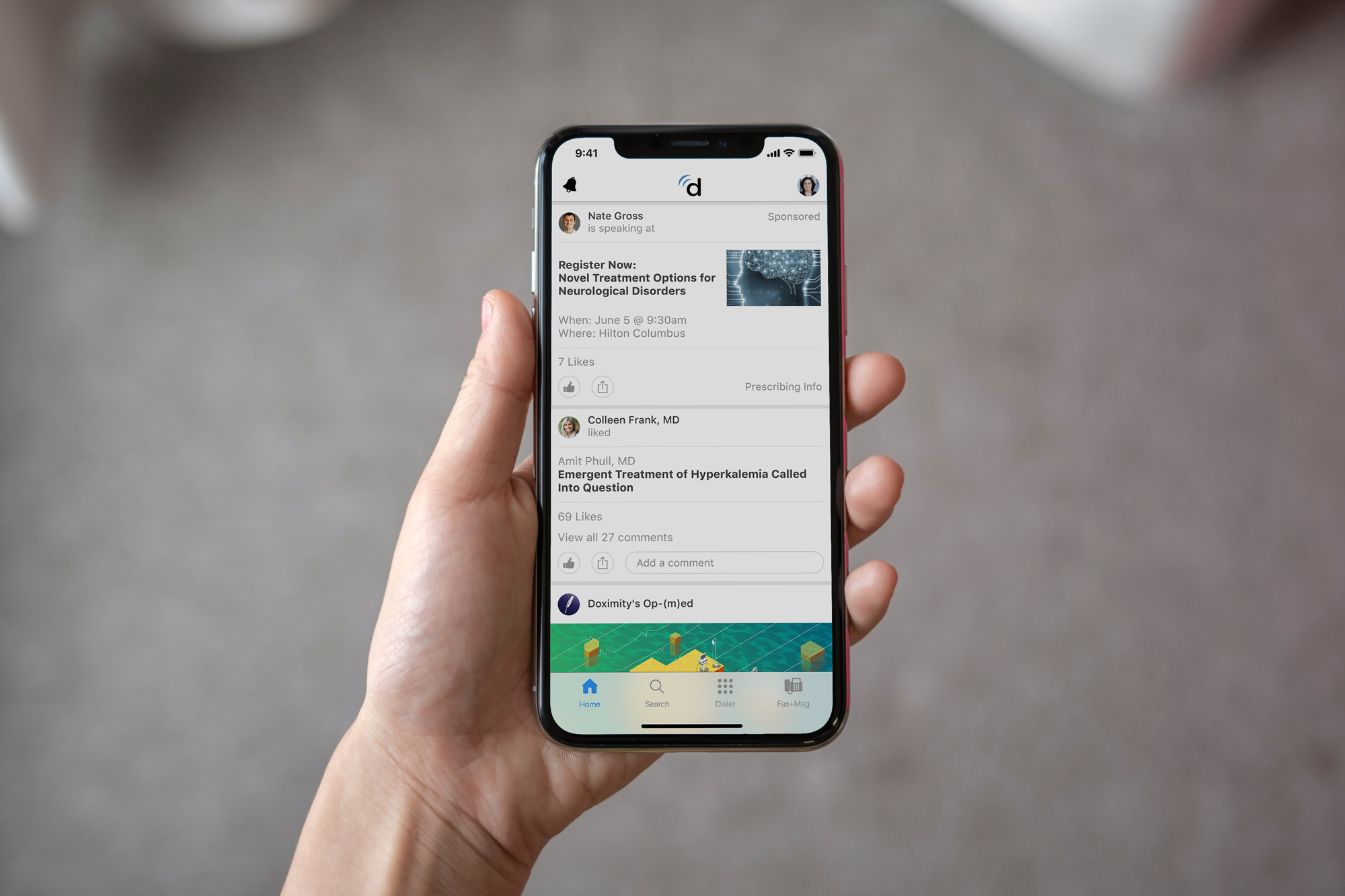

A health care social networking platform, Doximity has filed for an IPO seeking to raise as much as $100 million. Dubbed the “LinkedIn for physicians,” Doximity hopes physicians jump on board—not just by joining the platform but by investing in the company.

Doximity will trade under the ticker symbol "DOCS" on the Nasdaq Exchange.

Doximity has flown under the radar until now.

Founded in 2011, Doximity is still a relatively unknown social networking platform despite being located in the tech hub of San Francisco. It hasn’t sought or raised any outside capital since 2014 and has collected $80 million in venture funding during its tenure as a private company.

Doximity’s modest beginnings might be a result of it not spending much on marketing during that time. However, the lack of marketing hasn’t stopped the company from generating profits. Doximity’s net profit jumped 69 percent to $50.2 million with a $206.9 million revenue—a 78 percent increase from the year before.

Also, Doximity has attracted a considerable number of industry professionals from the top 20 hospitals, health clinics, and pharmaceutical manufacturers. According to Doximity’s filing, the platform hosts over 80 percent of U.S. physicians, which represents about 1.2 million users.

Doximity hopes physicians invest in the company.

Perhaps the most intriguing aspect of Doximity’s IPO filing is that 15 percent of the available shares are being saved for physicians. The “reserved share program” isn’t the first of its kind, but it's one of the more aggressive in recent memory.

When Uber unveiled its IPO in 2019, the ride-sharing company allocated 3 percent of the offering for its drivers. However, Uber’s share program hasn’t faired as well for drivers who invested in Uber from the beginning. At the IPO price, shares are up just 14 percent compared to the Nasdaq Composite performance of 74 percent over that same stretch.

Recently, Airbnb released a similar program leaving 7 percent of its IPO offering to property hosts on the platform. Shortly after its IPO, Airbnb shares climbed 112 percent but have since regressed to initial IPO levels.

It isn't a guarantee that Doximity shares will see a similar rally after the IPO. The addition of a large portion of investors from its customer base could help provide an initial boost.

Doximity is becoming the go-to site for health care professionals.

Doximity is rapidly becoming the leading platform for health care professionals, recruiters, and researchers. By allowing physicians to connect, read up on new research, and help hospitals to recruit new employees, Doximity is becoming an essential tool for the health care industry.

This growing presence has helped Doximity gain more than 600 subscription customers. Among the subscription customers, 200 of them have spent $100,000 so far in 2021. Meanwhile, 29 of them have spent at least $1 million. Subscriptions account for about 93 percent of the total revenue, according to the filing.

During the COVID-19 pandemic, Doximity introduced a telehealth product for patients to communicate with their doctors remotely. The company started charging for the telehealth service in January 2021.