Do Crypto Loans Without Collateral Exist? Where to Look

Cryptocurrency markets might be able to tap in and break through global markets with crypto loans without collateral.

Oct. 13 2021, Published 8:20 a.m. ET

Crypto natives are familiar with crypto loans since they serve as the backbone of open lending protocols without any viable alternatives. Since crypto aims to be "trustless," loans tend to be over-collateralized. Over-collateralization highlights one of the barriers for those who might want to enter the space—not having the initial capital to provide collateral to take out a loan.

Uncollateralized crypto loans are seen as one of DeFi's missing elements. They're speculated to be a crucial step in providing accessibility to crypto lending to most of the world.

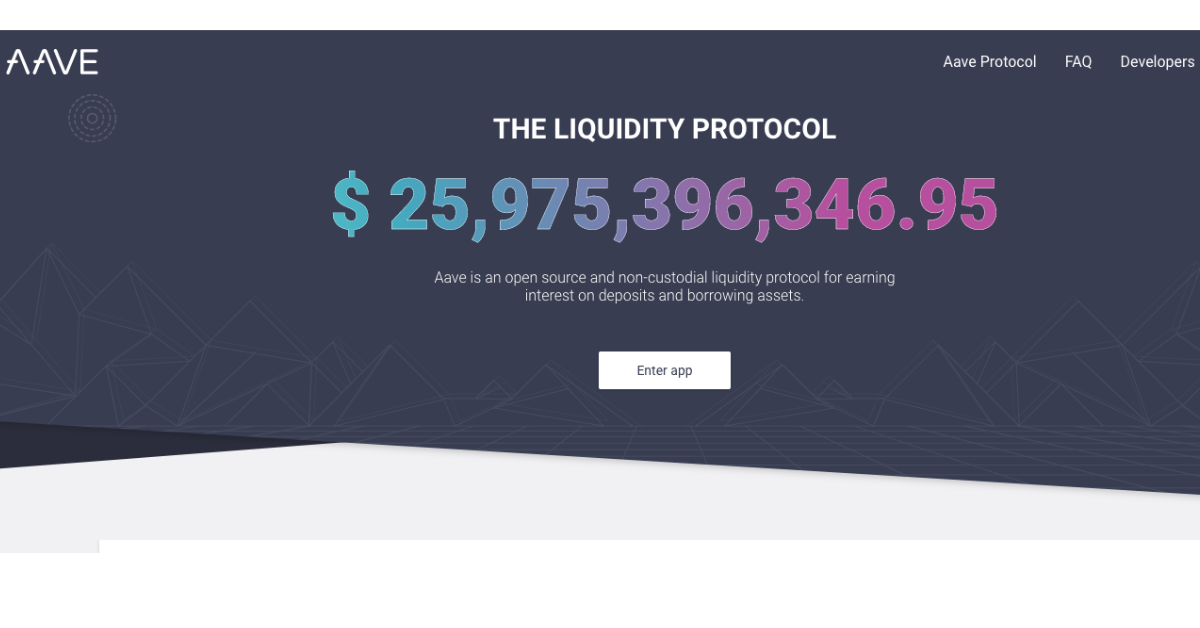

First, Goldfinch is one platform to keep an eye on. It aims to unlock one the the "biggest missing pieces of DeFi"—loans without collateral. Aave uniquely implements a lending protocol that offers semi-collateralized loans, partially solving the issue of "over" collateralization.

However, many experts agree that with the limitless capabilities of the Ethereum blockchain, solving the issue is possible. The network lends itself to innovative and new alternatives to lending.

Goldfinch: Crypto loans without collateral

Goldfinch recognized that a big barrier for new borrowers into the crypto ecosystem is the lack of capital [crypto] they have as an initial investment. It developed a protocol that enables crypto borrowing without any cryptocurrency needed as collateral. Instead, it incorporates the principle of "trust through consensus."

This consensus implements a protocol that creates a way for borrowers to show creditworthiness based on the "collective assessment of other participants" rather than their crypto assets. The collective assessment is used as a signal to trigger the automatic allocation of capital.

In eliminating the need of providing crypto as collateral, and by providing a means for passive yield, the protocol increases "both the potential borrowers who can access crypto and the potential capital providers who can gain exposure."

Aave: Semi-collateralized loans

Allegedly, Aave took the first step into uncollateralized lending with its credit delegation product. It allows one user to “delegate” their collateral to another. A borrower can loan out more than their collateral would normally cover.

In this way, the Aave protocol functions as a semi-collateralized loan since the borrower uses the capital of a liquidity provider as collateral to take out a loan.

However, while Aave took a step towards reframing how lending protocols operate, the loan itself is still over-collateralized. If the loan defaults, the entire collateral is at risk of liquidation.

A new series of unsecured protocols are emerging.

Now, there are emerging models that impose elements of loan conditions and risk tolerance on each group of loans. They also place the power to vote on new borrowers and loans in the hands of token holders—essentially the implementation of governance.

Constantly refining the use of the technology to improve its service and versatility in the lending ecosystem, unsecured lending is starting to take a new form in DeFi. Unsecured lending will now consider the composition of all five "C's" and no longer just collateral or conditions. It will consider the character of the borrower, the loaner's capacity based on debt-to-income ratio, and the amount of capital the borrowers have available.