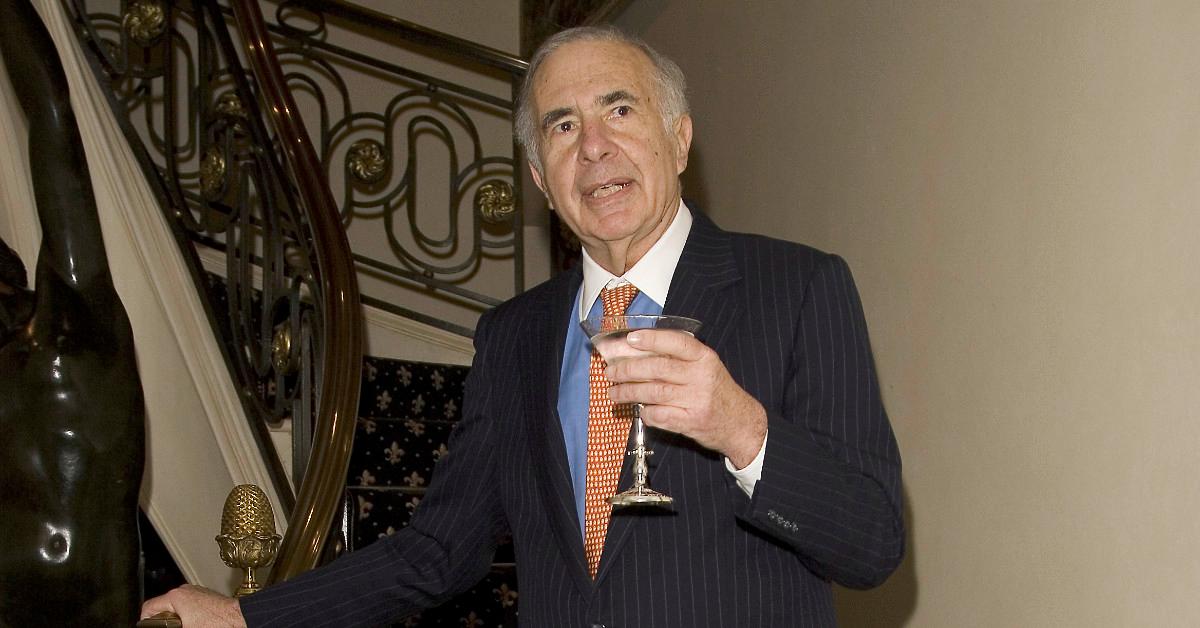

Carl Icahn’s Portfolio: What Companies Has the Billionaire Invested In?

What’s in Carl Icahn’s portfolio? Learn more about the legendary financier, the subject of the new HBO documentary ‘Ichan: The Restless Billionaire.’

Feb. 14 2022, Published 6:29 p.m. ET

A new HBO documentary will give Wall Street observers a better look at Carl Icahn, a man with a multi-billion portfolio and “a feared negotiator and master strategist in the art of corporate takeovers and investments,” as HBO says in its synopsis.

The doc, Icahn: The Restless Billionaire shows how this “Lone Wolf of Wall Street” became one of the richest and most influential people in business. Icahn has built up a fortune in the range of $16.7 billion, according to Forbes, and he has been at the “forefront of some of the most legendary business deals of our times,” as HBO adds.

Ahead of the documentary, here’s what we know about Icahn’s portfolio.

Icahn’s SEC filing showed a $22.5-billion portfolio.

The portfolio Icahn detailed in his most recent 13F filing with the SEC has a market value of $22.5 billion, as Seeking Alpha reports. At the time of the filing, more than half of that value came from his more than 247 million shares in his Icahn Enterprises L.P. (Nasdaq: IEP).

He also had significant investments in Cheniere Energy Inc. (NYSE American: LNG), Occidental Petroleum Corp. (NYSE: OXY), and CVR Energy Inc. (NYSE: CVI), all of which contributed more than $1 billion to the portfolio.

Lesser stakes included Newell Brands Inc. (Nasdaq: NWL), Bausch Health Companies Inc. (NYSE: BHC), Cloudera Inc. (now private), Herc Holdings Inc. (NYSE: HRI), FirstEnergy Corp. (NYSE: FE), Xerox Corp. (Nasdaq: XRX), Dana Inc. (NYSE: DAN), Welbilt Inc. (NYSE: WBT), Conduent Inc. (Nasdaq: CNDT).

And contributing less than 1 percent of the portfolio’s value were Icahn’s investments in Delek US Holdings Inc. (NYSE: DK), Southwest Gas Holdings Inc. (NYSE: SWX), and SandRidge Energy Inc. (NYSE: SD).

He says activism is “the best way to invest, by far.”

In an interview on CNBC’s Halftime Report last October, Icahn said that “the best way to invest, by far, is activism.” But he also observed that there are “tremendous” barriers to activism these days.

“It’s very hard to break into that business because, number one, most of these hedge funds that want to be in it don’t have permanent capital,” he explained. “And without permanent capital, sometimes you have to go into this activism and you have to wait 2, 3, 4 years, as we’ve done in many cases.”

But the 85-year-old also said that the Icahn name carries a lot of weight.

"The other reason we can do it over the years is that we have a brand name, a true brand name, sort of like Coca-Cola," he said on the show. “So, when we come along, the targets or even the advisors of the target, know we’re never gonna go away if we don’t get at least board seats and the ability not to micromanage but to give macro advice.”

The new documentary explores Icahn’s “fascinating contradictions.”

In a trailer for Icahn: The Restless Billionaire, Andrew Ross Sorkin discusses one of the questions around Icahn’s reputation. “Is he an activist investor representing the little guy or a corporate raider for Carl Icahn?” Sorkin asks.

The documentary, directed by Bruce David Klein, “explores the fascinating contradictions at the heart of the famed financier, Carl Icahn,” HBO explains. “In his own words and with commentary from family members, journalists, and fellow titans of industry, Icahn: The Restless Billionaire probes Icahn’s humble roots, his business acumen, and his obsessive drive to stay atop America’s corporate hierarchy.”

Icahn: The Restless Billionaire airs Tuesday, Feb. 15, at 9 p.m. ET.