Biden Versus Trump—Comparing Tax Plans and What Will Change

On April 28, President Biden will address Congress to unveil his tax changes. How does his plan compare to Trump’s 2017 tax plan?

April 28 2021, Published 3:43 p.m. ET

In 2017, Trump passed the Tax Cuts and Jobs Act. The bill made significant changes to the tax code in the way of deductions and tax brackets. Despite not being as radical as Republicans had initially proposed, it still caused quite a stir.

Fast forward four years to President Joe Biden’s agenda and a tax overhaul has been a priority since he took office just over 100 days ago. Biden is set to hold a meeting with a joint session of Congress in the evening on April 28 to unveil sprawling changes to the 2017 tax plan passed by Republicans and Trump. Because the two were enthralled in a polarizing election last year, it’s only natural to compare Biden’s tax proposal to Trump’s tax plan.

How Biden will change the current tax brackets

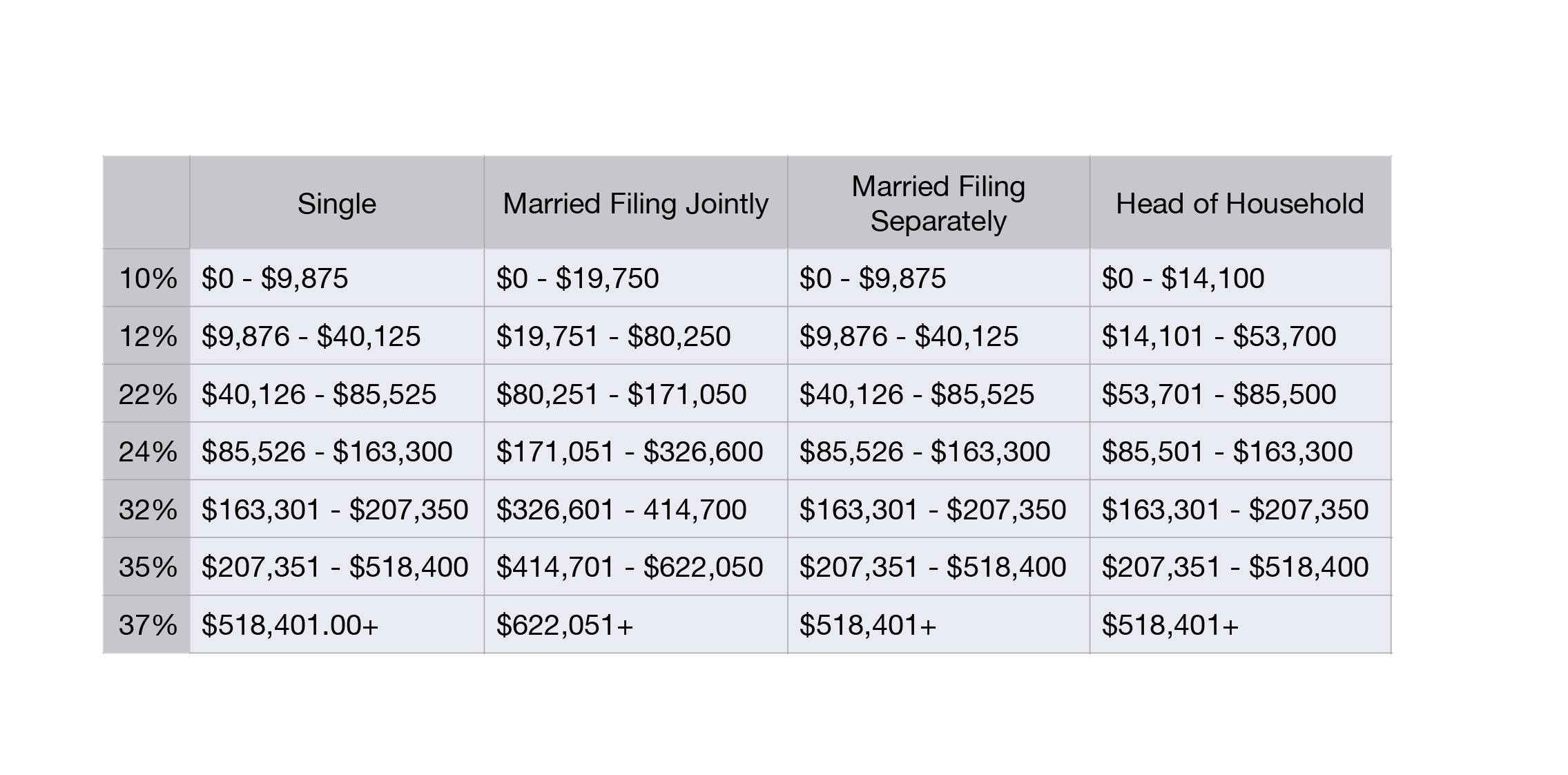

When the 2017 Tax Cut and Jobs Act was passed, Republicans initially proposed a four-tax bracket system. This would have impacted a much broader swath of taxpayers. Ultimately, seven tax brackets were created and saw the tax rates for the wealthy decrease.

However, Biden’s tax plan proposes the highest tax bracket go back to 39.6 percent, where it was prior to the 2017 bill. Biden has said that he won't raise taxes on anyone who earns less than $400,000 annually. With this indication, it doesn’t seem likely that the lower tax brackets will be affected. If anything, they might be lowered.

Biden will raise the corporate tax rate back to pre-Trump era levels.

One of the more controversial elements of Trump’s 2017 tax plan was a drastic lowering of the corporate tax rate. While Republicans are notorious for demanding lower taxes, it was odd that the most drastic tax cuts went to corporations who regularly do what they can to avoid paying taxes altogether. Under Trump’s tax plan, the corporate tax rate dropped from 35 percent to 21 percent.

President Biden is proposing an increase to the corporate tax rate—although not fully back to pre-Trump levels. Under Biden’s tax plan, the corporate tax rate would increase to a compromising 28 percent.

Biden has two other significant changes in terms of corporate tax policies. He hopes to establish a minimum 15 percent tax for corporations, meaning that every corporation pays at least 15 percent income tax on all revenue reported to investors regardless of any tax breaks or other loopholes. Biden also plans to tax foreign profits of American corporations at 21 percent in an attempt to curb the off-shoring of profits, while Trump’s bill placed this rate at 10.5 percent.

A proposed increase in capital gains taxes has already started to scare investors.

Currently, capital gains are taxed at a 20 percent rate. Trump flirted with the idea of lowering the capital gains tax, which he said would reduce overall middle-class tax burdens. However, studies have shown that the top earners in America own the vast majority of the stock market.

Biden wants to treat capital gains the same as all other income. Short-term capital gains—profits on assets held for less than a year—are currently taxed at the standard income tax rates. Biden’s tax plan singles out taxpayers who earn more than $1 million. The plan aims to tax their long-term capital gains—profits on assets held for more than a year—at the same rate as income earned through wages and bonuses. This could be a significant change for high-income earners who are used to receiving large profits from trading their assets.