Best War and Defense Stocks to Buy Amid Developments in Afghanistan

Many investors are turning their attention to war and defense stocks as the Taliban takes over Afghanistan. Here are some of the best picks.

Aug. 16 2021, Published 10:32 a.m. ET

After the Taliban takes control in Afghanistan, some people fear that the U.S. and its Western allies might face increased terrorist threats. For investors, the situation in Afghanistan is bringing renewed attention to defense stocks. What are the best war or defense stocks to buy now?

Osama Bin Laden and Al-Qaeda planned the September 11, 2001, attack on the U.S. from Afghanistan. The Taliban was in control of the country at that time. The U.S. invaded Afghanistan following the terrorist attack and managed to topple the Taliban from power.

Now, U.S. troops are leaving Afghanistan and the Taliban has regained control. Will Al-Qaeda and other terror groups hostile to the U.S. and its allies re-emerge? That’s the question many people are asking as the Taliban takes control of Afghanistan again.

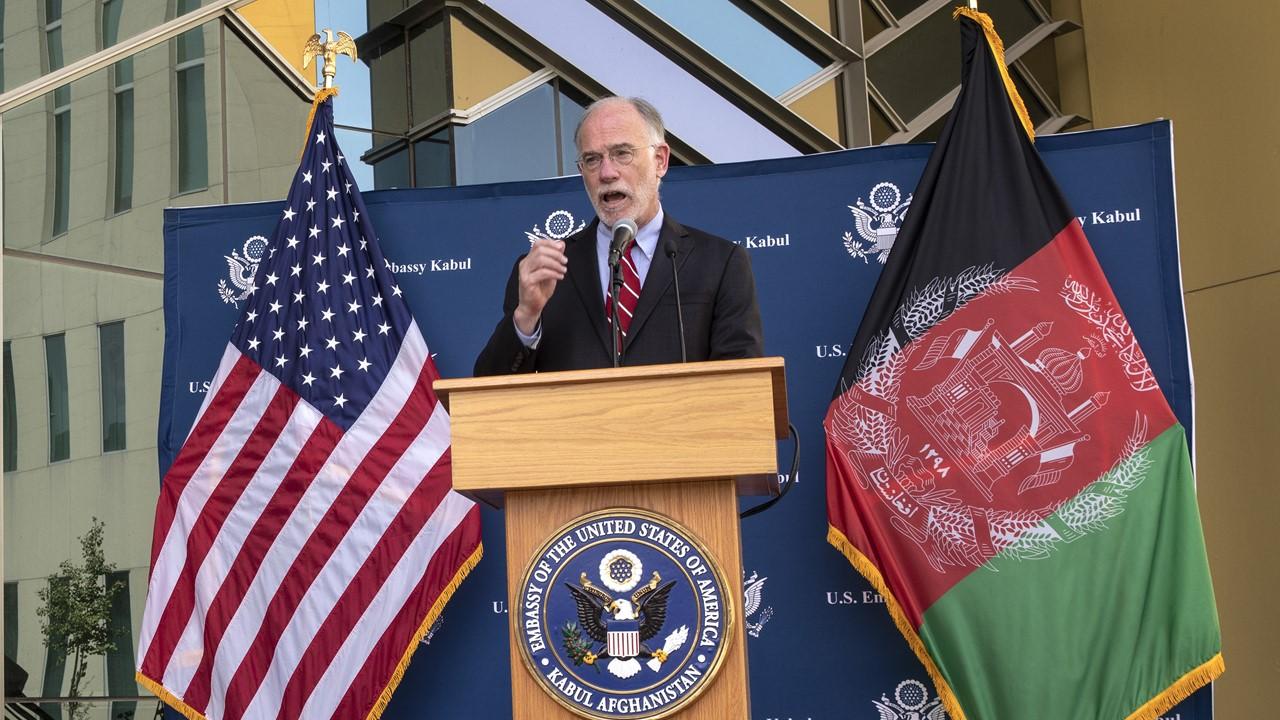

U.S. defense in focus as the Taliban takes over Afghanistan

The situation in Afghanistan puts the Pentagon on high alert. Many members of Congress are concerned about the collapse of the U.S-backed government in Afghanistan and the rise of the Taliban. The U.S. and its allies might have to ramp up their defense and counterterrorism measures.

If the U.S. decides to dial up its defense spending in response to the situation in Afghanistan, some companies stand to benefit. These range from companies that supply military weapons to those that offer IT and intelligence surveillance solutions to the Pentagon. Investors will be looking for the best war stocks to buy in these areas as they anticipate increased Pentagon alertness.

What are the best war or defense stocks to buy now?

The best war stocks are those of companies that supply the Pentagon and U.S. allies. Here are some of the defense stocks worth watching now following the developments in Afghanistan.

Lockheed Martin (LMT)

Northrop Grumman (NOC)

General Dynamics (GD)

Kratos Defense (KTOS)

Huntington Ingalls Industries (HII)

Boeing (BA)

Leidos (LDOS)

Raytheon Technologies (RTX)

Lockheed Martin (LMT) has a long history as a Pentagon supplier. It makes fighter jets and missile systems among others. The company is profitable and pays dividends. Currently, LMT stock offers a dividend yield of about 3 percent.

The U.S. defense organization obtains crucial machines and systems from Northrop Grumman (NOC) including drones and bombers. NOC defense stock offers a dividend yield of 1.73 percent at the current stock price.

General Dynamics (GD) builds military ships and vehicles. It provides defense technology to the Pentagon. Huntington Ingalls Industries (HII) also is a military shipbuilder. GD stock has gained more than 30 percent in 2021 and currently offers a dividend yield of 2.4 percent. HII stock has gained 20 percent in 2021 and offers a 2.21 percent dividend yield.

Kratos Defense (KTOS) makes military drones. The company is profitable, but KTOS stock is down about 18 percent in 2021. Away from making commercial jets, Boeing (BA) also supplies the Pentagon.

Leidos (LDOS) provides technology and solutions that are important to defense intelligence. The company is profitable and pays dividends. LDOS stock is down about 10 percent in 2021.

Raytheon Technologies (RTX) makes missile defense systems and electronic components that go into many defense systems. RTX stock has gained more than 20 percent in 2021. The company is profitable and pays dividends. Currently, Raytheon offers a dividend yield of 2.34 percent.

Finally, how the Pentagon is going to respond to the development in Afghanistan isn't clear. The U.S. defense organization is likely thinking about how to enhance its capabilities to better protect Americans if the situation in the Middle East pose more threat to U.S. national security.