The Price of Solana: Why it Fluctuates and What Traders Can Learn

Solana's price has varied greatly in the past, making traders feel both excited and cautious.

Jan. 16 2026, Updated 2:39 p.m. ET

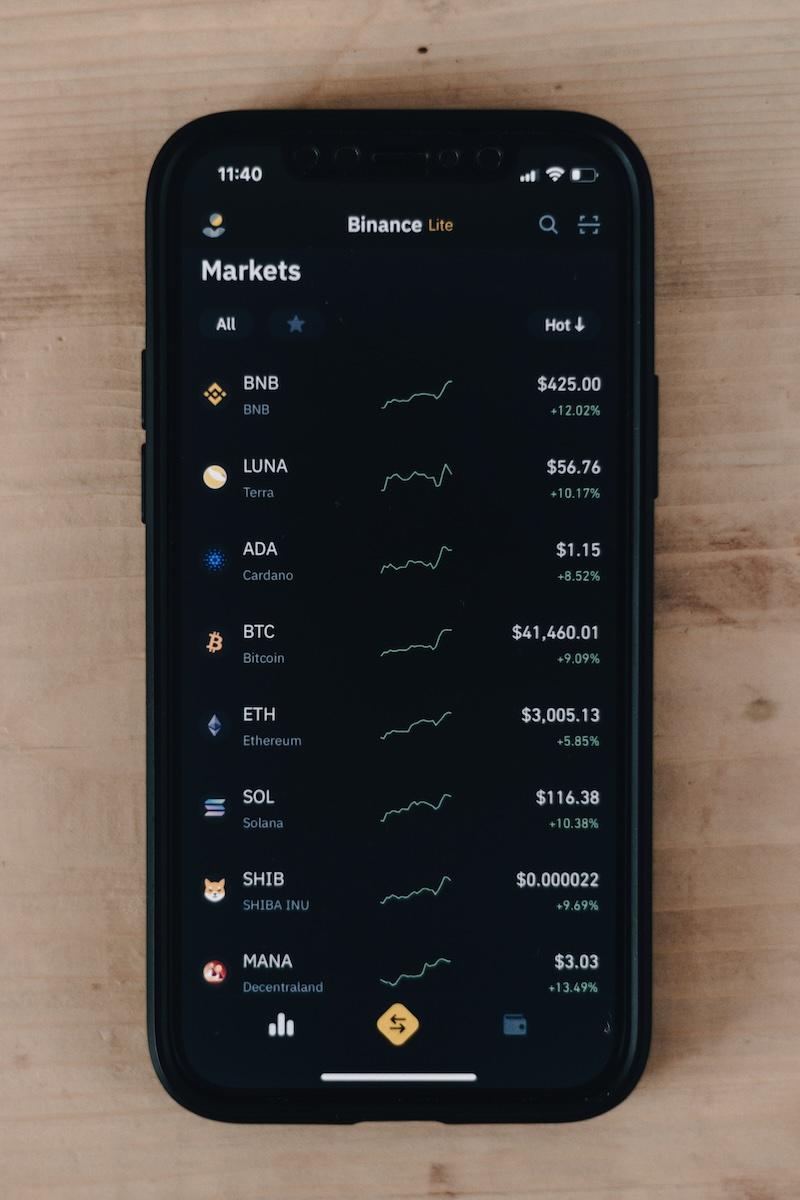

Right now, people are paying close attention to the Solana price. Traders monitor it for shifts in momentum. Long-term holders view it as an indicator of the ecosystem's health. New investors observe its significant volatility to grasp how unpredictable the market can be. Solana's price has varied greatly in the past, making traders feel both excited and cautious. Understanding why these changes occur helps traders make better decisions.

It's not just the high-speed tech that makes SOL so volatile. Changes in liquidity, trading behavior, and the rapid dissemination of market news are also to blame. When these things come together, the price can change suddenly and with great force. If you want to understand what's going on in the market, knowing what causes these changes will help you navigate more easily.

Why the Solana Price Moves Fast

Solana is one of the most liquid altcoins on major centralized exchanges. High-frequency traders and algorithmic systems that move in and out of positions in seconds are drawn to its liquidity. When activity grows, the order book can shift quickly. This can cause prices to rise significantly.

The same liquidity can become thin during times of low volume. Since there are fewer buyers and sellers in each price range, even small orders can cause big changes. This is one reason SOL often experiences large intraday price swings when trading slows at night.

Momentum is also important. When SOL starts to move, traders who are good at fast-paced markets often jump in and speed up the direction. This makes a feedback loop that keeps volatility going for short periods of time.

For instance, a group of day traders who are active sees a price breakout in the early morning. They get in quickly, which increases momentum for a short but strong burst. This is what happens with assets known for quick response times, and Solana is near the top of that list.

Volume Spikes Around News Events

News often acts as fuel for volatility. When something happens in the Solana ecosystem, the price usually changes within minutes. These can be things like mainnet upgrades, airdrop campaigns, big partnerships, and rounds of funding for projects that use Solana.

When news spreads, traders quickly adjust their prices to reflect the new information. Some want to gain early profits, while others want to get out of their positions before liquidity shifts. When volume rises rapidly, prices often fluctuate noticeably, especially if exchanges become busy or order books don't update quickly enough.

Picture a popular Solana-based game announcing a significant update. Traders anticipating higher user activity may attempt to buy early. This would drive short-term demand. Even if the news is positive, a quick reaction can trigger a spike followed by a pullback as the market settles.

This phenomenon occurs frequently in the Solana ecosystem, as builders are always working and there are often announcements.

Solana Trading: Technical Analysis Patterns

A lot of traders use technical analysis to deal with SOL's ups and downs. They look at patterns, trendlines, and indicators to find points where things are likely to change. Because of its liquidity profile, Solana often reacts strongly to these zones.

Support and resistance levels often form very close to each other. Traders often expect either a big bounce or a clear breakdown when the price gets close to these levels. The 20-day and 50-day moving averages are also important. Traders watch how SOL acts around these markers to see if momentum is getting stronger or weaker.

Another indicator often used is the relative strength index (RSI). Solana's rapid price movements usually cause RSI to cross overbought or oversold levels within short windows. Some momentum traders rely on these signals to execute reversal trades or continuation strategies.

A potential example is a swing trader recognizing that SOL has bounced from a well-tested support zone three times. They might take a small position and expect a different reaction, using a tight stop-loss because moves can change quickly. This is a common pattern among Solana traders who like things to be organized when the market is unstab

Risk Factors Only Present in Solana

Solana's technology powers its speed, but network performance concerns still influence trader sentiment. Past outages remain part of the network's history. Even though the ecosystem has improved stability, traders continue to react strongly to any sign of performance strain.

Token unlock cycles also matter. When large amounts of SOL become available for trading, supply temporarily increases. This can create downward pressure if demand does not rise at the same pace.

Safety is also essential. If an exploit affects a major Solana-based protocol, traders may reduce their risk across the entire ecosystem. These occurrences make volatility worse because they change people's minds faster than technical indicators can.

Strategies for Navigating Solana’s Volatility

It's important to remember that volatility isn't always a threat. Some traders use volatility to their advantage via scalping, range trading, or volatility breakouts.

Risk controls remain essential. Trailing stop losses, clear targets, and defined entry rules can help protect capital. Solana rewards preparation, as price movements can accelerate quickly once momentum builds.

A possible use case is a trader holding off on taking a position until a confirmed breakout above resistance occurs. They reduce risk and avoid speculation by letting the move develop. This methodical approach aligns well with Solana's rapid market structure.