Michael Orzano

Michael Orzano is Director of Product Management, Global Equity Indices at S&P Dow Jones Indices (S&P DJI). He is responsible for the product management of S&P DJI’s global equity, REIT, and Islamic indices and leads S&P DJI’s efforts developing new benchmarks for international equity markets and promotes their use among global clients. He also regularly publishes research, analytical reports, and market commentary on a variety of international investment topics including emerging markets, global REITs and Islamic Finance.

Prior to joining S&P DJI, Mike was a research analyst at Endurance Capital, a New York-based private equity firm, where he was responsible for evaluating investments in banks and other financial institutions. He has also worked as an investment performance analyst at Cambridge Associates.

Mike holds a bachelor’s degree in Economics from Georgetown University. He is also a CFA charterholder and a member of the New York Society of Security Analysts.

Disclosure: The content Market Realist publishes should not be construed as investment advice, nor do the opinions expressed necessarily reflect the views of S&P Dow Jones Indices.

More From Michael Orzano

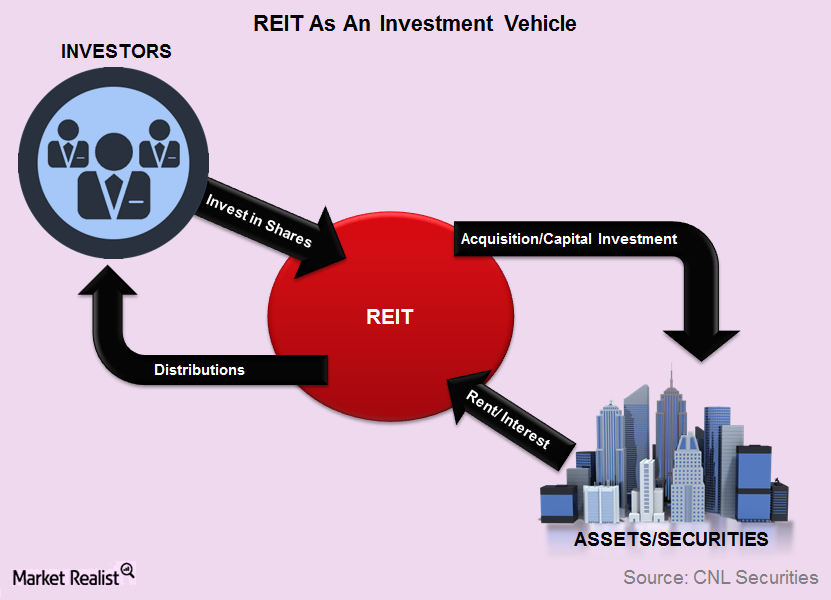

REITs 101: Understanding this Investment Vehicle

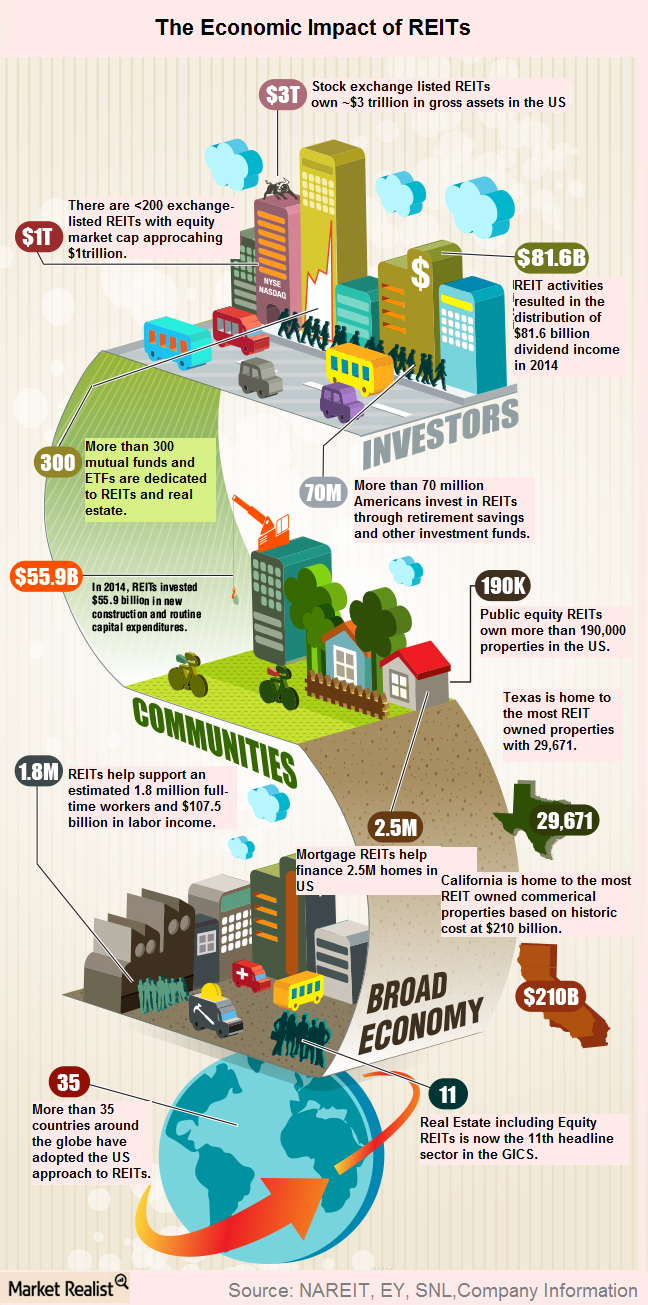

In this series, we’ll get down to the brass tacks of investing in the REIT sector, the market’s current landscape, and the benefits you can expect from this type of investment.

REITs 101: Understanding this Vehicle

By Michael Orzano, Director, Global Equity Indices Publicly traded property stocks, including real estate investment trusts (or REITs) and real estate operating companies (or REOCs), allow investors to gain exposure to real estate, which is generally an illiquid asset class, without sacrificing the liquidity benefits of listed equities. They also typically offer higher yields than […]

Why Look to REITs for Opportunities?

HEDGING AGAINST INFLATION Property stocks and REITs have often been viewed as inflation hedges because expected inflation will affect prices of real estate, and rental income tends to rise along with generalized inflation. However, other factors may mitigate the impact of inflationary forces. Some of these additional factors may include real estate supply and demand […]

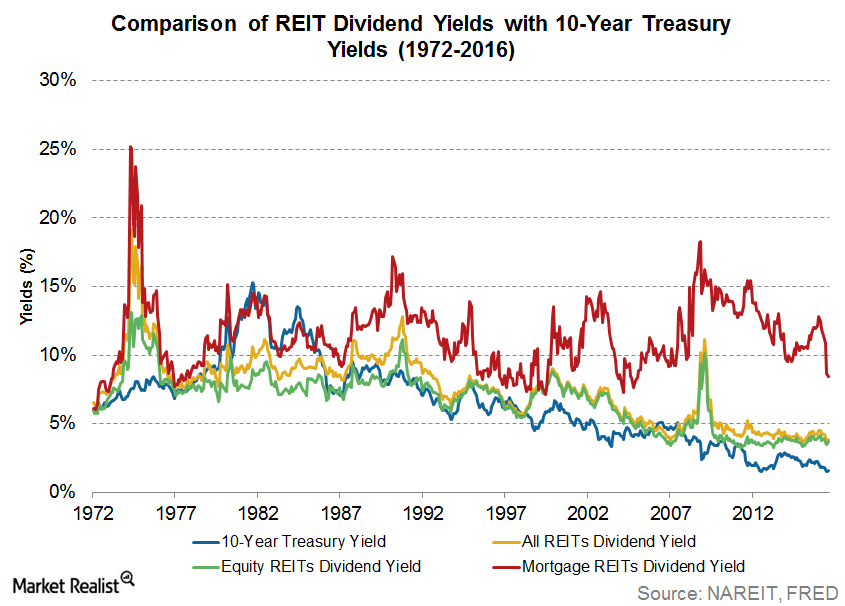

Why REITs Tend to Offer High Dividend Yield

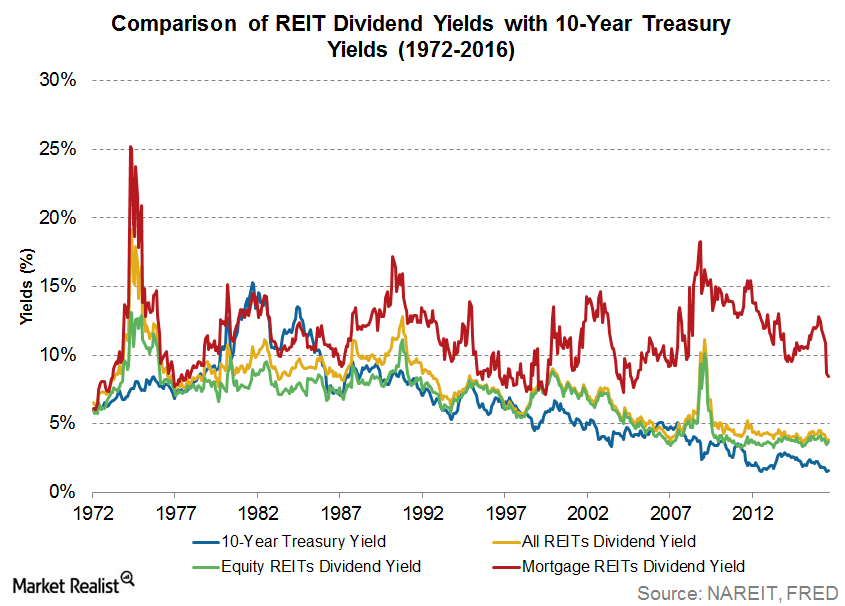

COMPARING DIVIDEND YIELDS ACROSS ASSET CLASSES Since 1999, approximately half of the total return of the Dow Jones U.S. Select REIT Index has come from dividends. During periods of heightened volatility, this income could act as a buffer and may mitigate negative price movements. Historically, the Dow Jones U.S. Select REIT Index has produced higher […]

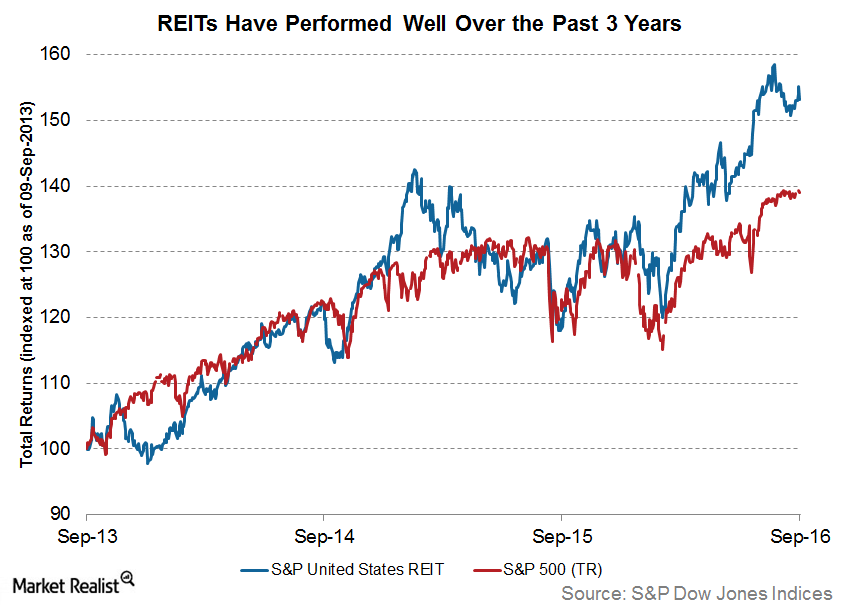

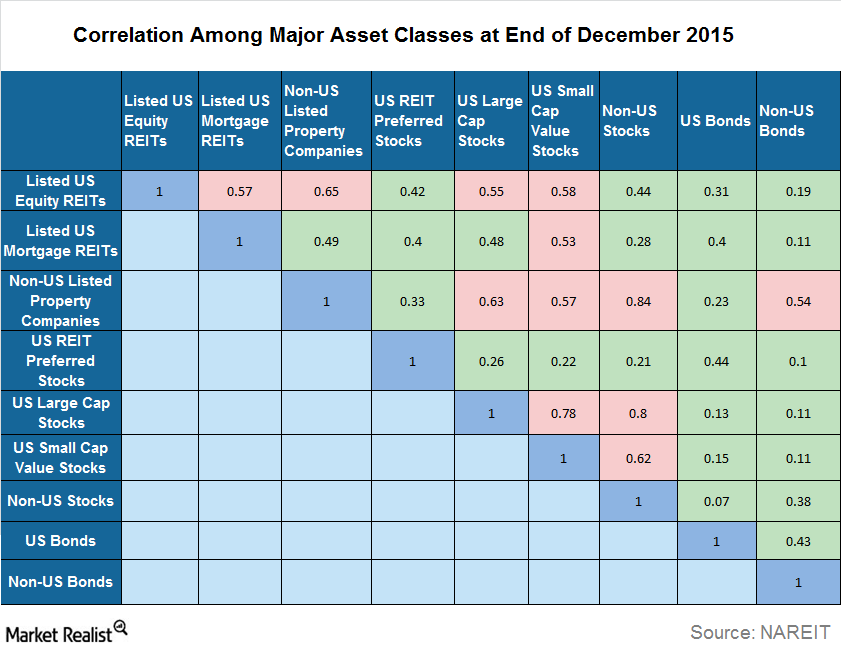

The REIT Advantage: High Return, Low Correlation

RETURNS AND RISKS OF REITS REIT and property stock performance has been relatively strong over the long term, especially when compared with traditional bond and equity indices. Since 1992, the Dow Jones Global Ex-U.S. Select RESI has had an average total return close to 9%, while the Dow Jones U.S. Select REIT Index has had […]

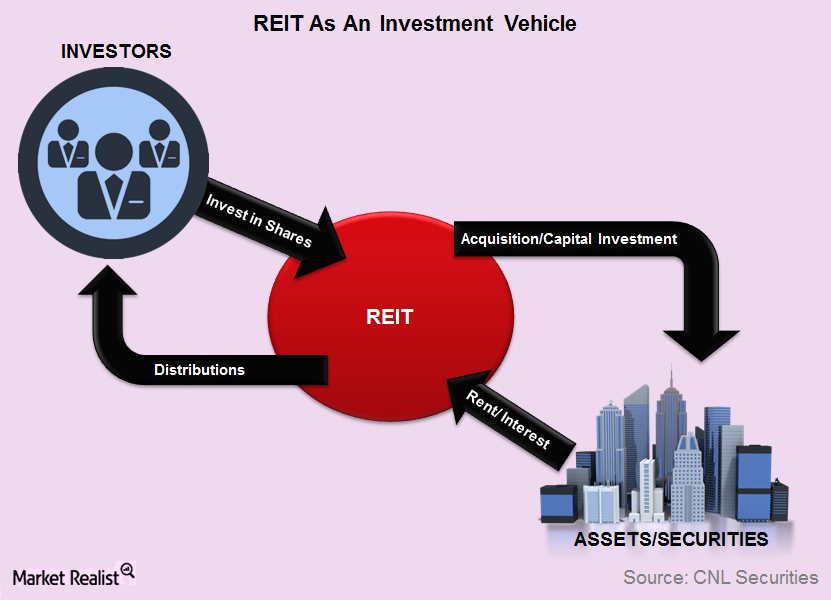

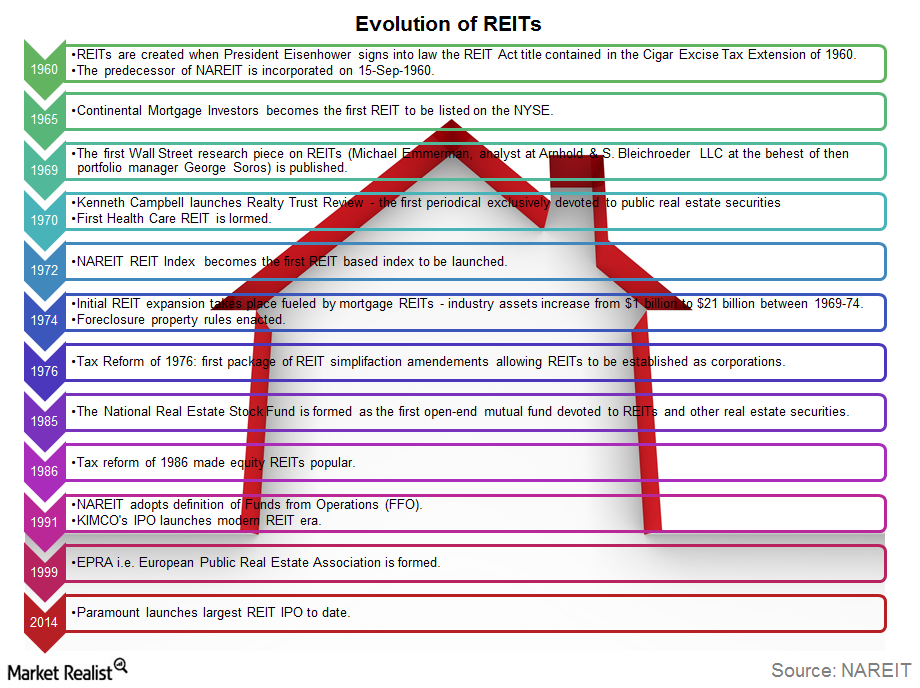

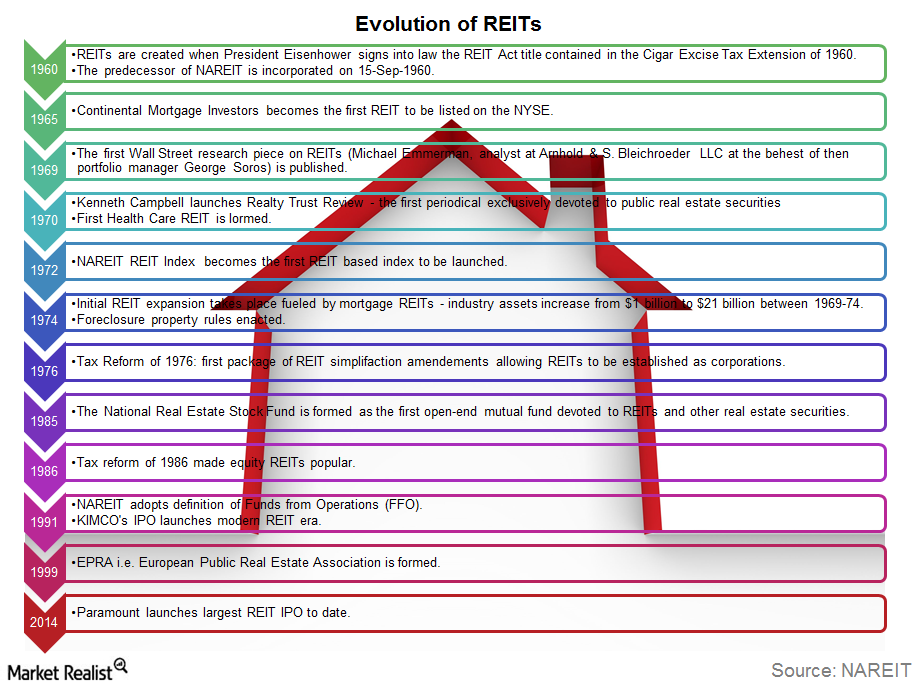

The Evolution of the REIT

The Evolution of REITs The basic concept of REITs originated with the business trusts that were formed in Massachusetts in the mid-19th century, when the wealth created by the industrial revolution led to a demand for real estate investment. The first REIT was set up in 1961, but it took several decades before REITs were […]

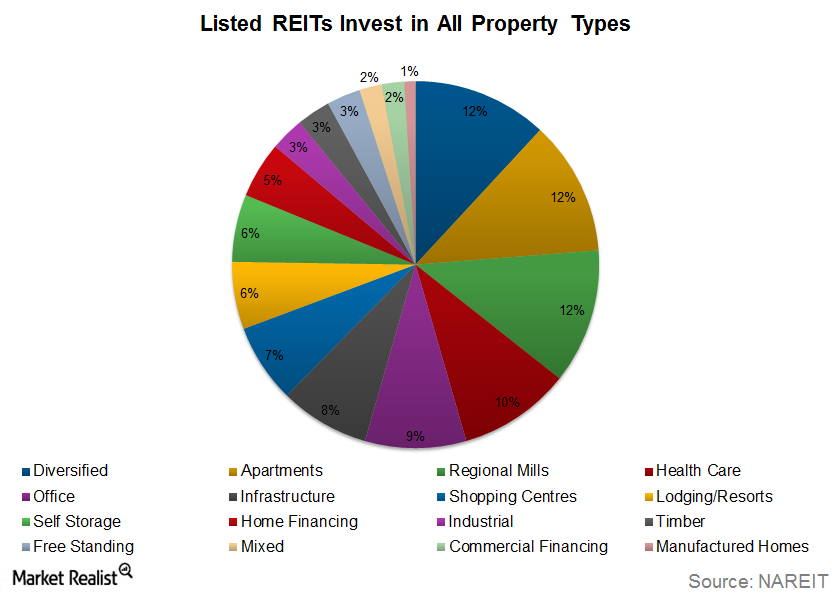

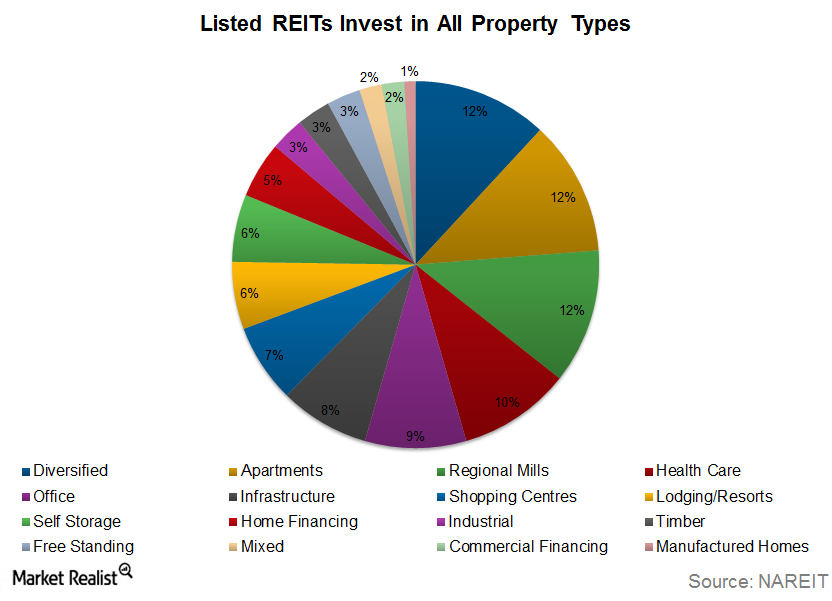

REITs Explained: Qualifications and Types of REITs

To qualify as a REIT, a company must have most of its assets and income tied to real estate investment and must pay out almost all of its taxable income to shareholders in the form of dividends. In the U.S., a REIT must meet the following four requirements. The REIT must distribute at least 90% […]

Why Look to the REIT Sector for Opportunities?

Not only do REITs (RWR)(ICF) help diversify a portfolio, but they also bolster portfolio income with their steady dividends and their long-term capital appreciation.

Why REITs Tend to Offer High Dividend Yields

REITs (IYR)(VNQ) are known for their high dividend yields, outclassing almost all other broad market indices.

The REIT Advantage: High Returns, Low Correlation

Not only do REITs tend to provide steady and stable returns over the long term, but they also help in diversifying investor portfolios effectively.

The Evolution of REITs

The REITs (IYR) sector has shown phenomenal growth over the years. In the past five decades, REITs have grown to a market cap of nearly $1 trillion.

REIT Explained: Qualifications and Types of REITs

Let’s talk about the two main types of REITs (ICF)—equity REITs and mortgage REITs.