Ann Hynek

Disclosure: The content Market Realist publishes should not be construed as investment advice, nor do the opinions expressed necessarily reflect the views of BlackRock.

More From Ann Hynek

Why Millennials Are Often Called ‘the Unluckiest Generation’

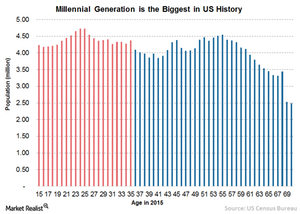

A population of 80 million strong in the U.S., millennials – those born between 1980 and 1999 – are breaking with tradition.

How Millennials Are Driving the Sharing Economy

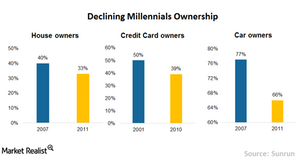

Millennials resonate with the idea of the sharing economy since it perfectly fits their budgets. Millennials took longer than expected to enter the job market—and at lower wages.

Why Quality of Life Is the New Money for Millennials

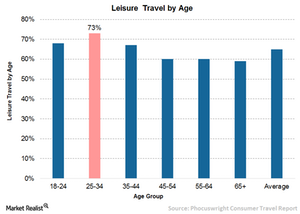

I believe that consumption demand patterns among millennials, including an emphasis on quality of life, is somewhat influencing this demand for travel and leisure, tech products and personal services.