ETF Investors Shift from Cyclicals to Defensives

Year-to-date, cyclical ETFs remain in the flow lead by over $1.37 billion even as both groups are now in outflows. Of course, this could change quickly.

Sept. 1 2020, Updated 10:52 a.m. ET

Cyclically defensive

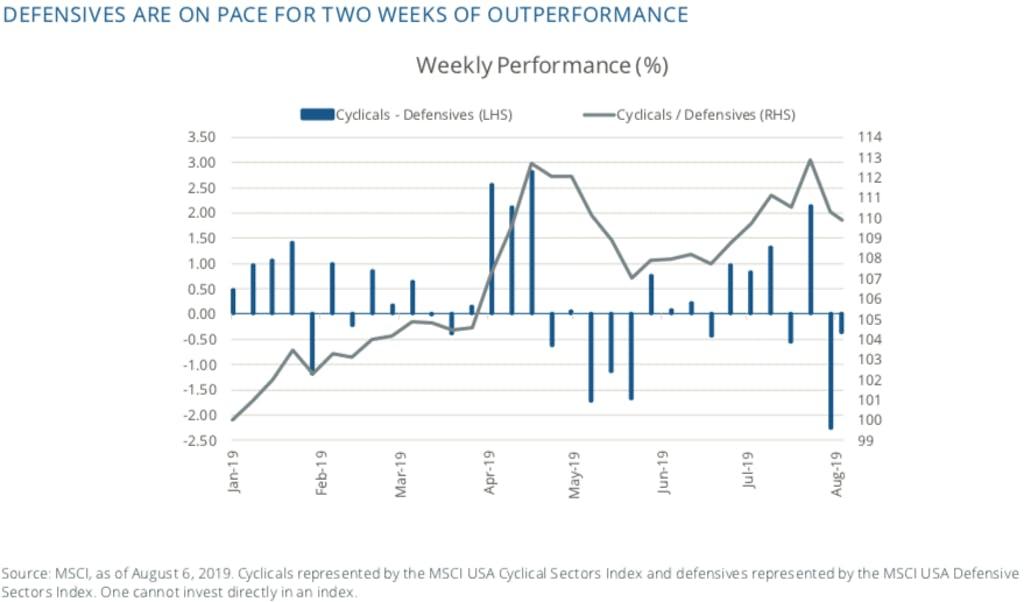

Escalation in the China-US trade war are helping drive cyclical sectors to be on pace for two weeks of underperformance relative to defensive sectors. When the closing bell rings on Friday if this occurs, it would mark the first time since May that cyclicals suffered consecutive weeks of negative relative returns.

While cyclicals may remain under pressure until the overall market stabilizes, we believe that accommodative monitory policy along with their firmer balance sheets will ultimately allow cyclical sectors to outperform defensive sectors.

What we’ve seen

- With the overall market down 1.91% so far in Q3, only four sectors are in the green. Two of these are cyclicals – real estate and communication services, while the other two – staples and utilities – are defensives. Thanks to the dramatic negative 8.27% return for energy stocks as crude oil has dropped, defensives on the whole are lagging cyclicals.

- It has only been the last days in July and first few in August that have driven down cyclicals. Energy continues to be the laggard this week underperforming the market by 1.29% with WTI crude oil down 3.65% on the week and 8.45% on the month. While some may not consider cyclicals to be defensive, their beta to the market is closer to one over the long-term than one may expect.

Money in motion

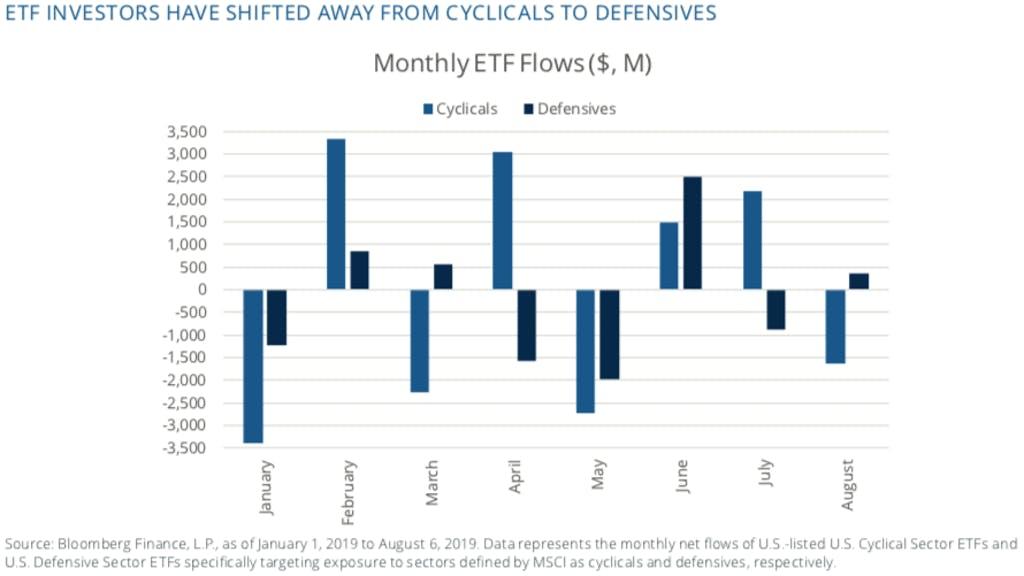

After seeing $2.17 billion of inflows in July, cyclical sector ETFs have lost $1.64 billion through the first 4 trading days in August, while defensive sector ETFs have largely experienced the opposite behavior with $874.44 million of outflows in July and $364.06 million of inflows in August.

- Unlike the May performance analogy, flows point to a different picture as both groups were in red that month highlighting how investors are being more discriminate in their recent bout of selling.

- Year-to-date, cyclicals remain in the flow lead by over $1.37 billion even as both groups are now in outflows. Of course, this could change quickly if the lead that cyclicals gathered in months like February, April and July starts to be diminished by investors flocking to perceived safer areas of the equity market.

What’s next?

What was missed during Monday’s selloff was a weaker than expected ISM Non-Manufacturing print of 53.7 from 55.1 in June. The services sector has been a source of strength for the US economy even as the manufacturing sector has been struggling. Should a trend of broadening economic weakness continue, we may reevaluate our positioning from a fundamental perspective.

- Outside of this manifestation, which would impact the markets at large negatively, investors should not be fooled that defensives are actually as defensive as they have been historically, especially as cyclicals offer superior operating margins and better return on equity.

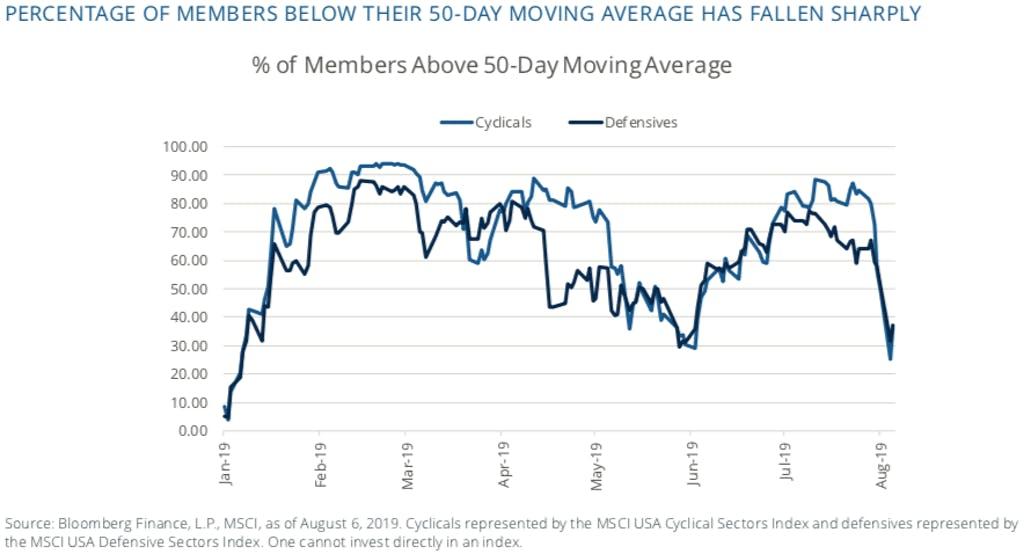

- Interestingly, both cyclical and defensive sectors witnessed the percentage of index members trading below their 50-day moving average drop sharply. In May, defensive names were struggling during the month prior to seeing cyclicals join them with furor in late May.

Implementation ideas

- The Direxion MSCI USA Cyclicals Over Defensives ETF (RWCD) allows investors an efficient means of overweighting cyclicals and underweighting defensives in one fund thanks to its unique 150/50 structure.

- With 150% long exposure to defensive sectors and 50% short exposure to cyclical sectors, the Direxion MSCI USA Defensives Over Cyclicals ETF (RWDC) offers investors the opposite exposure – a fund that overweights defensives and underweights cyclicals.

Definitions

- MSCI USA Cyclical Sectors Index: The MSCI USA Cyclical Sectors Index is based on MSCI USA Index, its parent index and captures large and mid-cap segments of the US market. The index is designed to reflect the performance of the opportunity set of global cyclical companies across various GICS® sectors. All constituent securities from Consumer Discretionary, Financials, Industrials, Information Technology and Materials are included in the Index.

- MSCI USA Defensive Sectors Index: The MSCI USA Defensive Sectors Index is based on MSCI USA Index, its parent index and captures large and mid-cap segments of the US market. The index is designed to reflect the performance of the opportunity set of global defensive companies across various GICS® sectors. All constituent securities from Consumer Staples, Energy, Healthcare, Telecommunication Services and Utilities are included in the Index.

An investor should carefully consider a Fund’s investment objective, risks, charges, and expenses before investing. A Fund’s prospectus and summary prospectus contain this and other information about the Direxion Shares. To obtain a Fund’s prospectus and summary prospectus call 866-476-7523 or visit our website at direxioninvestments.com. A Fund’s prospectus and summary prospectus should be read carefully before investing.

Shares of the Direxion Shares are bought and sold at market price (not NAV) and are not individually redeemed from a Fund. Market Price returns are based upon the midpoint of the bid/ask spread at 4:00 pm EST (when NAV is normally calculated) and do not represent the returns you would receive if you traded shares at other times. Brokerage commissions will reduce returns. Fund returns assume that dividends and capital gains distributions have been reinvested in the Fund at NAV. Some performance results reflect expense reimbursements or recoupments and fee waivers in effect during certain periods shown. Absent these reimbursements or recoupments and fee waivers, results would have been less favorable.

Direxion Relative Weight ETFs Risks – Investing involves risk including possible loss of principal. The Funds’ investments in derivatives may pose risks in addition to, and greater than, those associated with directly investing in or shorting securities or other investments. Cyclical stocks tend to rise and fall with the business cycle and are typically companies that provide consumer discretionary good or services. Defensive stocks tend to remain stable during various phases of the business cycle due to constant demand for products. Defensive stocks generally include utility and consumer staples companies that produce goods bought out of necessity. There is no guarantee that the returns on the Funds’ long or short positions will produce high, or even positive returns and a Fund could lose money ifeitherorbothoftheFund’slongandshortpositionsproducenegativereturns. Pleaseseethesummaryandfullprospectusesfora more complete description of these and other risks of the Funds.

Distributor for Direxion Shares: Foreside Fund Services, LLC.