Short-Term Headwinds Affect NVIDIA’s Return on Investment

NVIDIA (NVDA) has enjoyed strong returns over the last two years as the AI revolution has driven demand for accelerated computing platforms.

May 27 2019, Published 3:30 p.m. ET

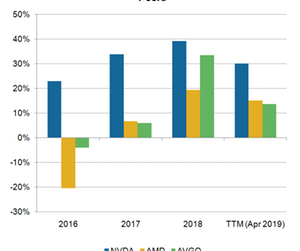

NVIDIA’s efficiency ratios

NVIDIA (NVDA) has enjoyed strong returns over the last two years as the AI revolution has driven demand for accelerated computing platforms. The company had a first-mover advantage in AI, which helped it grow in terms of both volumes and ASP (average selling price).

However, its volumes began to fall by the end of fiscal 2019 as the US-China trade war and the end of the crypto trend slowed demand in its two major markets of data center and gaming. The company’s profits were affected, and so were its returns.

A company’s ROI (return on investment) reflects its management’s ability to generate maximum returns from minimum investment. NVIDIA is spending on the future growth platforms of gaming, automotive, AI, and professional visualization, but its short-term headwinds have slowed its returns.

Return on investment

A company’s ROI measures the income it earns on total investments. Long-term investors and companies use ROI metrics to compare investment opportunities and identify those that generate the highest returns.

NVIDIA’s ROI rose from 22.9% to 39.05% between 2016 and 2018 driven by higher volumes and ASPs. However, its ROI for the trailing 12 months leading up to April 2019 fell to 29.9% as demand slowed. Its rival Advanced Micro Devices also took a hit, but the impact was milder as the decline in consumer graphics processing unit sales was partially offset by growth in central processing unit sales.

Amid the semiconductor slowdown, NVIDIA is acquiring Mellanox Technologies to help it increase semiconductor content in the data center and deliver a complete AI solution from cloud to edge. Acquisitions also help boost ROI. One big success story when it comes to acquisitions is Broadcom, which improved its ROI in 2018 by realizing cost synergies from acquisitions. NVIDIA’s 2019 ROI will be lower than the last year’s, but it should see a boost in 2020.