How Fortinet’s Earnings Growth Has Trended

Fortinet (FTNT) has managed to improve profitability over the years with sales growth.

April 25 2019, Published 3:46 p.m. ET

Fortinet’s increase in profit margins

Fortinet (FTNT) has managed to improve profitability over the years with sales growth. The company’s sales have risen 3x from $615 million in 2013 to $1.8 billion in 2018. Fortinet has managed to improve net margin from 7.2% in 2013 to 18.4% in 2018.

Fortinet has an operating leverage multiple of 1.18x for 2019, which indicates that for every rise in dollar revenues, the operating profit might rise by $1.18. The operating leverage is expected to improve to 1.30x in 2020.

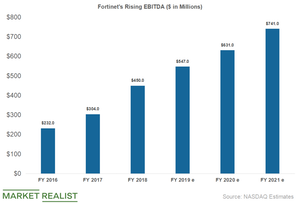

In the last quarter, Fortinet managed to double GAAP (generally accepted accounting principles) operating profit to $231 million. Fortinet’s EBITDA (earnings before interest, tax, depreciation, and amortization) has risen from $232 million in 2016 to $450 million in 2018 and is estimated to rise to $741 million by 2021.

Earnings estimated to rise 18.2% in 2019

Wall Street expects Fortinet’s earnings to rise at a lower rate compared to revenue for 2019. The company’s non-GAAP (generally accepted accounting principles) EPS will likely expand by 13% to $2.08 this year. Analysts expect the company’s EPS to rise 13.5% to $2.6 in 2020 compared to its sales growth of over 13%.

Analysts expect Fortinet’s EPS to rise at a CAGR (compound annual growth rate) of 25% over the next five years, which is below the CAGR of 38% in its EPS in the last five years. The five-year EPS CAGR for Palo Alto Networks (PANW), Check Point (CHKP), FireEye (FEYE), and Proofpoint (PFPT) are 27%, 8%, 114%, and 25%, respectively.