Alibaba Unit Secures Hong Kong Virtual Banking License

Alibaba (BABA) looks to be on track to expand its financial services business in Asia.

May 21 2019, Published 1:16 p.m. ET

Tencent and Xiaomi units also handed virtual bank permits

Alibaba (BABA) looks to be on track to expand its financial services business in Asia. According to a Reuters report, Alibaba recently secured a license allowing it to operate a so-called virtual bank in Hong Kong through its Ant Financial affiliate. The license was issued to Ant SME Services, a unit of Ant Financial, which is expected to begin providing virtual banking services in the next six to nine months.

A virtual bank license allows a holder to provide banking services over the Internet without the need to open physical bank branches. Other entities that have recently been awarded virtual bank licenses in Hong Kong include joint ventures involving Tencent (TCEHY) and Xiaomi, one of the world’s top smartphone companies. Xiaomi sold 122.4 million smartphones worldwide in 2018 and captured 7.9% of the global market, thereby ranking in fourth place worldwide, according to Gartner data. Samsung (SSNLF) ranked first with a 19% global market share.

Alibaba and Tencent dominate China’s mobile payment market

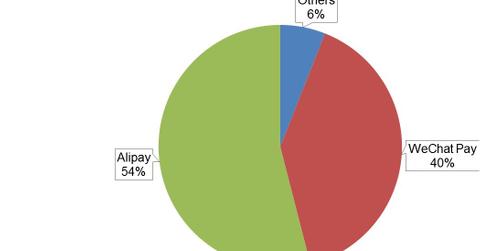

Alibaba (through its Ant Financial affiliate) and Tencent are the top providers of digital financial services in China. Their mobile payment apps Alipay and WeChat Pay, for instance, control more than 90% of the mobile payment market in China, according to iResearch.

In addition to payment processing, Ant Financial is also into the lending and fund management businesses. Amazon (AMZN) also lends to small businesses, and it recently launched its loan service in China.

A few years ago, Ant Financial sought to jump-start its entry into the global money remittance business with the acquisition of MoneyGram (MGI), but the deal fell apart after American regulators couldn’t approve it due to national security concerns.