Can Whole Foods Expansion Help Revive Amazon’s Revenues?

Amazon (AMZN) has been struggling due to slow revenue growth and higher investments in 2019 in hiring and capital spending.

April 2 2019, Updated 2:15 p.m. ET

Amazon facing sluggish revenue growth

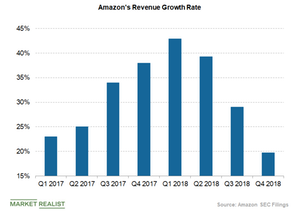

Amazon (AMZN) has been struggling due to slow revenue growth and higher investments in 2019 in hiring and capital spending compared to year-ago levels. In the fourth quarter of 2018, Amazon’s revenue growth was the slowest since the first quarter of 2015 despite strong holiday sales. Revenues grew 19.7% YoY in Q4 2018, but the growth was lower than the preceding quarter’s growth of 29% and the year-ago quarter’s growth of 38%.

WAKE UP WITH BAGELS & STOX, OUR NEW EMAIL THAT ENTERTAINS AND INFORMS YOU BEFORE THE DAY STARTS. SIGN UP HERE!

Growth avenues for Amazon

Amazon has been operating in many areas such as healthcare, original TV shows, and movies, as well as the smart home market with voice-assistant Alexa, to generate revenues. Amazon Prime’s streaming music and video subscription services, audiobooks (Audible), and ebooks (Kindle Unlimited) are also gaining momentum. Amazon also believes that its brick-and-mortar sales through its Whole Foods division will add to revenues.

Amazon’s aim to expand Whole Foods stores

Amazon has been looking to expand its Whole Foods stores since its acquisition in 2017 to boost its Prime Now service. Amazon Prime Now’s two-hour free delivery service is currently available in more than 60 US cities, and the company is planning to make its service available in 500 Whole Foods stores.

The company has also offered exclusive discount deals to its Prime customers and has slashed Whole Foods’ prices on hundreds of items amid efforts to gain market share in the US grocery space and compete with grocery giants such as Walmart (WMT), Kroger (KR), and Costco (COST).