A Look at Arista’s Revenue and Earnings Growth in 2019 and Beyond

Arista Networks’ revenue growth has been impressive in recent years. The company is operating in the mature hardware networking segment.

April 23 2019, Published 12:17 p.m. ET

Revenue growth for Arista estimated at 23.3%

Arista Networks’ (ANET) revenue growth has been impressive in recent years. The company is operating in the mature hardware networking segment, and its growth rate far outpaces that of the overall market.

Analysts expect ANET’s revenue to rise 23.3% YoY (year-over-year) to $2.65 billion in 2019 compared to $2.15 billion in 2018. Its sales are then expected to rise 20.4% to $3.19 billion in 2020 and 17% to $3.75 billion in 2021.

Cisco’s (CSCO) sales are expected to rise 4.8% in its current year. Juniper Networks (JNPR) and Hewlett Packard Enterprise (HPE) are expected to experience sales declines of 3.4% and 0.2%, respectively, this year.

Earnings expected to rise over 16% in 2019

Though ANET’s sales are expected to rise over 23% this year, its EPS could actually expand at a slower pace, indicating low operating leverage. In 2019, ANET’s non-generally accepted accounting principles EPS are expected to rise 16.2% in 2019 to $9.25 from $7.96 in 2018. The company’s EPS are then expected to rise 16.8% to $10.8 in 2020.

Analysts expect ANET’s EPS to rise at a CAGR (compound annual growth rate) of 18.5% over the next five years, far below the CAGR of 51% in its EPS in the last five years.

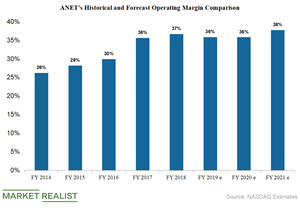

Profit margins

ANET’s operating margin could contract from 36.7% in 2018 to 35.8% in 2019. The company’s operating margin is expected to expand to 35.9% in 2020 and to 37.7% in 2021. Arista’s operating leverage is expected to be 0.88x in 2019 and 1.0x in 2020, which means that for every dollar increase in revenue in 2019, Arista’s operating profit will increase by $0.88.

Companies with high operating leverages are able to expand their bottom lines at a far more robust pace in periods of revenue growth.