Where Does Booking Holdings Stand among Peers?

Booking Holdings (BKNG) stock is currently trading at a discounted PE valuation multiple to its peers Ctrip.com International (CTRP), TripAdvisor (TRIP), and Expedia (EXPE).

March 4 2019, Updated 10:00 a.m. ET

PE multiple

Booking Holdings (BKNG) stock is currently trading at a discounted PE valuation multiple to its peers Ctrip.com International (CTRP), TripAdvisor (TRIP), and Expedia (EXPE). Booking, Ctrip, TripAdvisor, and Expedia have PE multiples of 20.51x, 22.80x, 31.84x, and 22.07x, respectively.

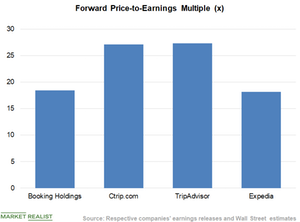

Based on Wall Street’s earnings forecast for the next 12 months too, Booking is trading at a discount to most of its competitors (IYW). Booking, Ctrip, Trip Advisor, and Expedia have forward PE multiples of 18.43x, 27.08x, 27.33x, and 18.19x, respectively.

EV-to-EBITDA multiple

The PE valuation multiple is the most commonly used ratio to compare companies because of its simplicity, but it has some flaws. The earnings of a company can be distorted due to the debt component in its balance sheet, which can make the multiple meaningless. So, it is better to compare companies based on their EV-to-EBITDA (enterprise value-to-EBITDA) multiples also, as it neutralizes the effect of leverage in the company.

Currently, Booking Holdings has an EV-to-EBITDA multiple of 16.00x. The valuation multiple is significantly lower than the multiple of peers Ctrip and TripAdvisor, which have EV-to-EBITDA ratios of 41.53x and 22.97x, respectively. However, the stock’s EV-to-EBITDA multiple is higher than that of Expedia’s 12.16x.

Similarly, based on analysts’ EBITDA forecast for the next 12 months, Booking is trading at a hefty discount to Ctrip while at a premium to TripAdvisor and Expedia. Booking, Ctrip, Trip Advisor, and Expedia have forward EV-to-EBITDA multiples of 14.10x, 20.60x, 14.29x, and 9.59x, respectively.