Understanding the Details of the Disney-Fox Deal

Yesterday, Walt Disney (DIS) gained control over most of 21st Century Fox’s (or 21CF’s) media and entertainment assets, including its film production and TV businesses, Hulu, and Star India.

March 21 2019, Updated 1:54 p.m. ET

Fox assets acquired by Disney

Yesterday, Walt Disney (DIS) gained control over most of 21st Century Fox’s (or 21CF’s) media and entertainment assets, including its film production and TV businesses, Hulu, and Star India. The $71.3 billion deal comprises ~$19.8 billion in cash being paid to 21CF shareholders, and the remaining is in stock. Disney also acquired 21CF’s debt of ~$19.2 billion.

Also, 21CF has completed its spin-off into a new entity, Fox Corporation (FOXA), which includes FOX News Channel, FOX Broadcasting Company, FOX Business Network, FOX Sports, FOX Television Stations Group, and sports cable networks FS1, FS2, Fox Deportes, and Big Ten Network.

Distribution of 21CF stock

According to the deal, Disney will receive ~74% of 21CF’s stock, while Fox Corporation will get the remaining 26%. Fox Corporation shareholders received about 1.26 shares for each share of 21CF.

Fox Corporation also announced its directors yesterday, appointing former House of Representatives speaker Paul Ryan and members of the Murdoch family. Lachlan Murdoch became CEO and chairman of Fox Corporation.

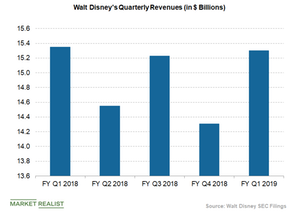

The deal is set to enrich Disney’s portfolio with Fox’s premium content, which could boost its revenue, expand its business overseas, and help it compete with digital rivals such as Netflix (NFLX) and Amazon (AMZN). The Fox deal could also help Disney’s streaming service, which is set to be launched later this year.