Trump’s Criticism Has Hurt General Motors Stock

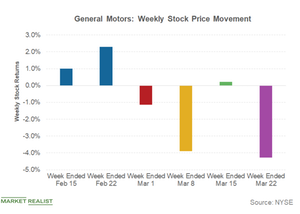

Last week, General Motors (GM) traded on a negative note and ended the week with 4.3% losses against an 0.8% drop in the S&P 500 Index.

March 26 2019, Updated 3:34 p.m. ET

GM stock

Last week, General Motors (GM) traded on a negative note and ended the week with 4.3% losses against an 0.8% drop in the S&P 500 Index. On Monday, March 25, the stock made a slight 0.9% recovery. On a month-to-date and a year-to-date basis, GM has returned -6.9% and 9.9%, respectively.

President Trump slammed GM

In the last couple of weeks, General Motors has faced criticism from Trump for its decision last November to close its Ohio factory. On March 16, Trump, in a tweet, asked the company to open its Ohio plant “Because the economy is so good.” In his next tweet, he criticized it saying, “G.M. let our Country down” and asked it to “Stop complaining and get the job done!”

Weakening US auto sales (XLY) have encouraged General Motors to focus on protecting profit margins without caring much about market share. To reduce pressure on its profitability, GM exited some of its geographical markets such as Europe and India in the last few years where it was struggling to remain profitable.

Key technical levels

As of March 25 closing, GM stock was trading at $36.75. Its 200-day simple moving average (or SMA) was hovering at $36.93, indicating a mixed bias in the price action. Its 14-day setup of RSI (relative strength index) was at 36.4, reflecting weakness in the momentum.

On the downside, immediate support lies near $36.00, while $37.65 could act as an immediate resistance level this week.