Dollar Tree’s Strategic Plans: Better Results in Fiscal 2019?

Analysts expect Dollar Tree’s sales to rise 3.8% to $23.7 billion in fiscal 2019. The adjusted EPS is expected to fall 2.2% to $5.33.

March 21 2019, Published 9:46 a.m. ET

Performance in fiscal 2018

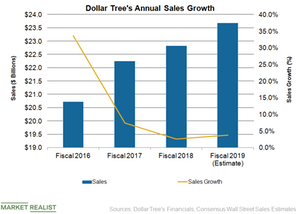

Dollar Tree’s (DLTR) net sales increased 2.6% to $22.8 billion in fiscal 2018, which ended on February 2. Dollar Tree’s overall same-store sales growth was 1.7% in fiscal 2018. The Dollar Tree banner’s 3.3% growth outperformed the Family Dollar banner’s 0.1% same-store sales growth.

Excluding the impact of one-time items, Dollar Tree’s adjusted EPS grew 12.1% to $5.45. However, the company’s gross margin and operating margin declined in fiscal 2018 due to higher markdowns and increased costs including freight. Dollar Tree recorded a $2.7 billion goodwill impairment charge associated with the Family Dollar business, which was acquired in 2015.

Growth expectations

Analysts expect Dollar Tree’s sales to rise 3.8% to $23.7 billion in fiscal 2019. The adjusted EPS is expected to fall 2.2% to $5.33. Analysts expect continued strength in Dollar Tree stores and an improvement in Family Dollar stores to drive the top-line growth in fiscal 2019. In the previous part, we discussed Dollar Tree’s accelerated transformation plans for its Family Dollar business. Dollar Tree also plans to open 350 new stores under its Dollar Tree brand and 200 new stores under the Family Dollar brand in fiscal 2019.

Dollar Tree was under pressure from activist investor Starboard Value. In January, Starboard Value suggested that the company explore various strategic alternatives for the Family Dollar business including a possible sale.

Dollar Tree expects its fiscal 2019 net sales to be $23.45 billion–$23.87 billion with a low-single-digit rise in same-store sales. Dollar Tree expects its fiscal 2019 EPS to be $4.85–$5.25. Higher costs and significant investments in growth initiatives might weigh on Dollar Tree’s EPS in fiscal 2019.