What’s Affecting Disney’s Revenue Growth?

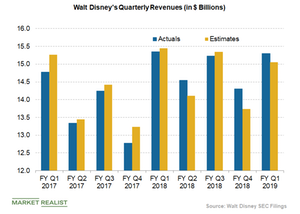

The Walt Disney Company’s (DIS) revenue of $15.30 billion exceeded analysts’ revenue expectation of $15.14 billion in the first quarter of fiscal 2019.

Feb. 6 2019, Updated 2:30 p.m. ET

Disney’s revenue trend

The Walt Disney Company’s (DIS) revenue of $15.30 billion exceeded analysts’ revenue expectation of $15.14 billion in the first quarter of fiscal 2019. The company has beaten revenue estimates three times in the past nine quarters. Its total revenue was almost flat compared to the previous year’s quarter, but it rose ~7% from the previous quarter’s revenue of $14.3 billion.

Media peers Comcast (CMCSA) and Netflix (NFLX) also reported their respective fourth-quarter results last month. Comcast’s revenue topped the consensus estimate by 1.1%, while Netflix’s revenue slightly missed the consensus estimate by 0.05%. Cable company Dish Network (DISH) has yet to release its fourth-quarter results.

Revenue drivers

In the quarter, Disney restructured its business segments amid its direct-to-consumer push. Disney’s Media Networks segment, which includes ESPN, delivered revenue growth of 7% YoY to $5.9 billion, mainly due to the 12% growth in its broadcasting business. Disney’s closely-watched ESPN division posted a fall in its operating income due to higher programming costs.

Disney’s newly restructured Parks, Experiences and Consumer Products segment posted revenue growth of 5% YoY to $6.8 billion driven by higher spending at its domestic theme parks and resorts.

Revenue in Disney’s Studio Entertainment segment plummeted 27% YoY to $1.8 billion due to its lack of blockbuster movies in the quarter compared to the comparable quarter last year. Disney’s films in the most recent quarter included Mary Poppins Returns and The Nutcracker and the Four Realms compared to last year’s box-office hits Star Wars: The Last Jedi and Thor: Ragnarok.

The company’s newly formed Direct-to-Consumer & International segment posted revenue of $918 million, down 1% YoY due to foreign currency headwinds. The segment also delivered a significant operating loss due to higher investment costs related to ESPN+ and the yet-to-launch Disney+.