Reduced Cloud Spending Slows Intel’s Data Center Revenue Growth

PC continues to be Intel’s biggest business, but its most important business is its DCG (Data Center Group), which has been driving its revenue growth.

Feb. 7 2019, Updated 7:31 a.m. ET

Intel’s Data Center Group

PC continues to be Intel’s (INTC) biggest business, but its most important business is its DCG (Data Center Group), which has been driving its revenue growth.

DCG serves four end markets: cloud, communications, enterprise, and government. The first two markets are DCG’s growth drivers, accounting for 66% of its revenue. The company saw stabilization in the last two markets in 2018, but it doesn’t expect any growth from them in 2019.

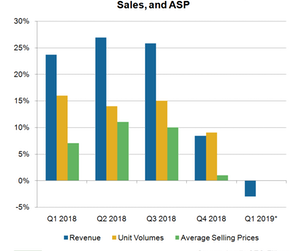

In the fourth quarter of 2018, Intel’s DCG revenue rose 8.4% YoY (year-over-year) to $6.07 billion, missing analysts’ estimate of $6.35 billion. Its revenue growth rate was lower than its growth rate of over 23% in the first three quarters of the year. DCG’s unit volumes rose 9%, while its ASP (average selling price) rose just 1% in the fourth quarter.

Cloud computing

Intel’s DCG revenue growth slowed as YoY revenue growth from cloud companies halved from 50% in the third quarter to 24% in the fourth quarter. Industry analysts stated that Chinese (FXI) data centers had accelerated their purchases to build stockpiles due to the threat of the US-China trade war. Intel stated that cloud companies had shifted from building capacity to absorbing capacity in the fourth quarter, which slowed DCG’s revenue growth.

Other data center verticals

DCG’s fourth-quarter revenue from CSPs (communication service provider) rose 12% YoY as customers continued to virtualize their networks to prepare for the advent of 5G technology. Even Xilinx (XLNX) reported a 33% YoY rise in its communications business driven by early 5G deployment. DCG’s revenue from enterprise and government fell 5% YoY.

Intel’s data center business in 2019

On Intel’s fourth-quarter earnings call, the general manager of DCG, Navin Shenoy, stated that he expects demand from the cloud to remain weak in the first half of 2019 as customers absorb the capacity. However, he expects cloud purchasing to pick up in the second half. Meanwhile, he expects CSP growth to remain strong in the first half as 5G deployment accelerates, increasing the demand for Intel’s network system-on-chip.

We expect Intel’s DCG revenue to fall 3% YoY to $5 billion in the first quarter of 2019, its first YoY fall in over two years. NVIDIA (NVDA) is also seeing a slowdown in the data center GPU (graphics processing unit) space as cloud companies lower their spending.

Next, we’ll look at Intel’s memory business.