New Year, New Direxions?

After a strong first half of 2018, the market cooled off along with the weather in August, and we had one of the worst fourth quarters in recent memory.

Aug. 12 2019, Updated 2:13 p.m. ET

Can the rally be sustained?

After a strong first half of 2018, the market cooled off along with the weather in August, and we had one of the worst fourth quarters in recent memory. However, after the worst Christmas Eve trading session in the stock market’s history, the market began its bounce. We are now having an incredibly strong start to 2019 with all major indices up significantly in January, including an 8.7% gain for the Dow Jones Industrial Average, a 9% gain for the S&P 500 Index, and an 11.4% gain for the NASDAQ Composite Index (as of February 5).

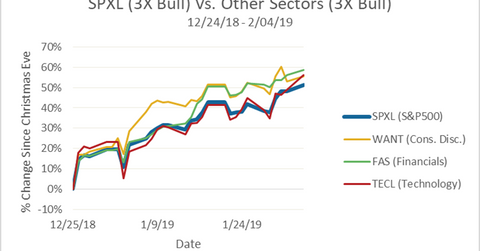

The surge in the market has led to solid gains for the financial (FAS, FAZ), technology (TECL, TECS), and consumer discretionary (WANT, PASS) sectors. Meanwhile, the communications services (TAWK, MUTE) sector has been a major underperformer. Take a look at the impressive returns for technology (3X), financials (3X), consumer (3X), and the overall market SPXL (3X). The SPXL is up over 50%, and everything else is up even more!

Source: Bloomberg. 12/24/18-2/04/19 Past performance is not indicative of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. For standardized performance, click here.

The only question on everyone’s minds now is: is the rally in January a sign of things to come in 2019, or will we face another significant sell-off like in 2018?

Are the financials finally in favor?

Going into 2018, a lot of “experts” said that banks would be the primary beneficiaries in a rising rate environment, but that simply was not that case. Why? Because while gradual rate hikes are good for banks, rapid increases are not. The rapid increase in rates caused fixed-income assets like bonds, which make up the majority of the assets on banks’ balance sheets, to decrease in value, and the benefits from higher rates like being able to charge more for loans could only partially offset this decrease.

Fortunately, the Fed has stated that it will take a more cautious approach to rate hikes in 2019, which means banks will finally have time to capitalize on the increase in rates without worrying about the negative impact of more increases in the near future. So does a lowering of rates portend well for the financials? Load growth should pick back up, but interest carry should get worse. Either way you see it, Direxion has the product for you: the FAS (3X Bullish) and FAZ (3X Bearish) financial leveraged ETFs. Take a look at this bounce-back with 3X bullish financials up an incredible whopping 60% since the Christmas sell-off.

Source: Bloomberg. 12/24/18-2/04/19 Past performance is not indicative of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. For standardized performance, click here.