Is Cleveland Cliffs’ HBI Plant an ‘Underappreciated’ Opportunity?

After Cleveland-Cliffs’s (CLF) debt repayment concerns were taken care of, it started refocusing on growth.

Feb. 12 2019, Updated 10:30 a.m. ET

HBI plant

After Cleveland-Cliffs’s (CLF) debt repayment concerns were taken care of, it started refocusing on growth. It is currently in the process of building an HBI (hot-briquetted iron) plant in Toledo, Ohio.

In fact, during its fourth-quarter results, the company announced it would increase its productive capacity from 1.6 million tons to 1.9 million tons per year. Lourenco Goncalves mentioned during the Q4 conference call, “We have explored, identified and implemented some significant project modifications, to allow us to reach this new annual capacity number of 1.9 million metric tons of HBI.”

The progress of the plant

Goncalves also mentioned that due to the increase in capacity, the initial budget of $700.0 million for its HBI plant would go up to $830 million. In preparation for the plant’s scheduled mid-2020 start, the company plans to divert 500,000 tons of pellets to its own site.

Underappreciated opportunity

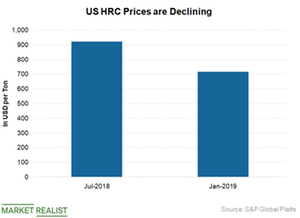

Goncalves noted during the call that, “the boost in profitability we expect to see from HBI is at best underappreciated by outside investors and at worst, not factored in at all in their valuation models.” He also added that in the last three months, the industry has seen many announcements of new electric arc furnaces (or EAFs) and capacity expansions. For these EAFs to be competing at the high end of steel specifications, they’ll need high-quality iron ore feedstock, “exactly what we are getting set to supply from our Toledo plant.”

Along with a large EBITDA contribution from the HBI plant, the company expects this to lead to margin expansion for the company.

Steel Dynamics (STLD) and Nucor (NUE) use EAFs to produce steel, while U.S. Steel (X) and ArcelorMittal (MT) mostly use iron ore for steel production.