Disney’s Capital Return Policy Looks Attractive

Capital return trends Leading media mogul The Walt Disney Company (DIS) has continued to improve its capital return policy, driven by attractive dividend payments and strong share repurchase programs. In fiscal 2017, the media giant returned ~$11.8 billion to shareholders via buybacks and dividend payments, compared with $9.8 billion in fiscal 2016. In fiscal 2018, the […]

Jan. 31 2018, Updated 9:02 a.m. ET

Capital return trends

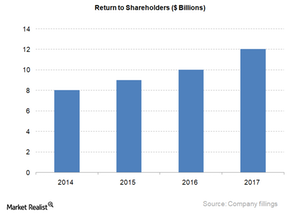

Leading media mogul The Walt Disney Company (DIS) has continued to improve its capital return policy, driven by attractive dividend payments and strong share repurchase programs. In fiscal 2017, the media giant returned ~$11.8 billion to shareholders via buybacks and dividend payments, compared with $9.8 billion in fiscal 2016. In fiscal 2018, the company plans to repurchase stock worth $6 billion.

Peer comparison

As shown in the graph above, the company has returned ~$44 billion to shareholders in the last five years through dividend payments and share repurchases, at an average of $8.8 billion every year. In fiscal 2017, the company distributed ~$2.4 billion (or $1.56 per share) in dividends, compared with $2.3 billion (or $1.42 per share) in 2016. Also, Disney hiked its dividends in 1Q18 by 7.7% to $1.68. Whereas Disney’s current dividend yield is 1.5%, media peers Comcast, CBS (CBS), News (NWSA), and 21st Century Fox (FOXA) have dividend yields of 1.5%, 1.3%, 1.2%, and 0.96%, respectively.

In fiscal 2017, Disney bought shares worth $9.4 billion, compared with $7.5 billion in 2016. In 4Q17, the company bought ~33.6 million shares for $3.4 billion. Disney exited 4Q17 with $8.7 billion in free cash flow. The company has maintained a healthy average free cash flow of ~$7.6 billion in the last four years and has a current debt-to-equity ratio of 0.55. Disney’s strong free cash flow and lower leverage may help it reach its capital return goal.