Why Verizon Continued to Lose Its Fios Video Customers

Verizon (VZ) reported Wireline segment revenue of $7.4 billion in the fourth quarter.

Jan. 30 2019, Updated 12:50 p.m. ET

Wireline revenue

Verizon (VZ) reported Wireline segment revenue of $7.4 billion in the fourth quarter. Verizon’s wireline revenue fell 3.2% YoY (year-over-year) in the quarter and was flat compared to the third quarter of 2018. Its wireline revenue fell 3% YoY to $29.8 billion in 2018.

The company’s total Fios revenue rose 2.9% YoY in the fourth quarter and 2.5% YoY excluding the impact of its revenue recognition standard. Fios is a fiber-optic network service that provides Internet, video, and voice services to its users. Fios video customer losses led to a fall in Verizon’s Wireline segment’s revenue in the quarter.

Falling number of Fios video customers

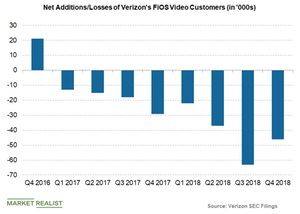

While the company witnessed an addition of 54,000 Fios Internet customers owing to strong demand for a high-quality Internet connection, the wireless service provider continued to struggle with a falling number of Fios video customers in the fourth quarter. Verizon also lost 30,000 Fios digital voice residence connections in the quarter.

The company has been losing Fios video customers for the past eight consecutive quarters, with 46,000 customers lost in the fourth quarter as viewers continued to prefer cheaper TV services over the Internet or expensive cable packages. Fios’s video customer losses totaled more than 29,000 in the fourth quarter, lower than analysts’ estimate of 51,000 video customer losses.

As of December 30, 2018, Verizon had ~4.451 million Fios video connections, a little lower than the 4.497 million connections it had in the third quarter and the 4.619 million connections in had in the previous year’s quarter.

Cord cutting

A large number of consumers have been shifting from traditional cable subscriptions to over-the-top offerings in a move that’s popularly known as “cord cutting.” Popular streaming service providers Netflix (NFLX), YouTube TV, Hulu Live TV, and Amazon Prime offer movies and TV shows directly to customers online at a cheaper rate than a cable or satellite connection.

To combat their digital rivals, TV distributors and programmers Dish Network and AT&T (T) have started focusing on their own streaming offerings, Sling TV and DIRECTV NOW, respectively. AT&T’s TimeWarner and the Walt Disney Company (DIS) are rolling out their streaming services in late 2019, while Comcast’s (CMCSA) NBCUniversal is planning to launch its streaming service in the first quarter of 2020.