Analysts Favor a ‘Buy’ Rating for iAnthus Capital

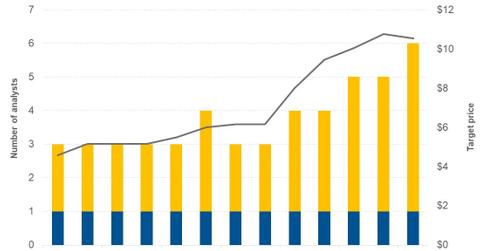

Of the six analysts that cover iAnthus Capital Holdings (IAN) (ITHUF), one analyst has given the stock a “strong buy,” while five analysts are favoring a “buy” recommendation.

Jan. 25 2019, Updated 9:01 a.m. ET

Analysts’ recommendations

Of the six analysts that cover iAnthus Capital Holdings (IAN) (ITHUF), one analyst has given the stock a “strong buy,” while five analysts are favoring a “buy” recommendation. On average, analysts have set a 12-month price target of 10.54 Canadian dollars, which represents an upside potential of 71.4% from its January 23 closing price of 6.15 Canadian dollars.

On January 18, Northland Capital initiated coverage on iAnthus Capital with an “outperform” rating and a price target of 9.50 Canadian dollars. Earlier, in October, Canaccord Genuity had raised its price target from 7.5 Canadian dollars to 9 Canadian dollars, and Cormark Securities increased its price target from 8.25 Canadian dollars to 9.25 Canadian dollars.

Peer comparisons

- Of the six analysts that follow MedMen Enterprises (MMEN) (MMNFF), two analysts have given a “strong buy” rating, while four are favoring “buys” on the stock. On average, analysts have given MMEN a price target of 8.18 Canadian dollars, which represents a potential upside of 101.9% from its January 23 closing price of 4.05 Canadian dollars.

- Of the ten analysts that follow HEXO (HEXO), two have given it “strong buy” ratings, and eight have given it “buy” ratings. On average, analysts have set a price target of 9.42 Canadian dollars on the stock, which represents a potential upside of 36.2% from its January 23 closing price of 6.92 Canadian dollars.

- Of the six analysts that cover Tilray (TLRY), three have given it “buys,” and three have given it “holds.” On average, analysts have given the stock a price target of $131.25, which represents a potential upside of 83% from its January 23 closing price of $71.74.

Valuation multiple

For iAnthus Capital’s valuation analysis, we’ve considered the forward EV-to-sales (enterprise value-to-sales) multiple, as the company is still in the growth phase. During this period, its expenses will be on the high side, so its EPS can’t be considered for valuation purposes.

As of January 23, iAnthus Capital was trading at a forward EV-to-sales of 1.39x. On the same day, its peers MedMen Enterprises (MMNFF) and Wayland Group (MRRCF) were trading at forward PE multiples of 4.09x and 2.22x, respectively.