Comparing Nordstrom’s Top-Line Growth with Peers’

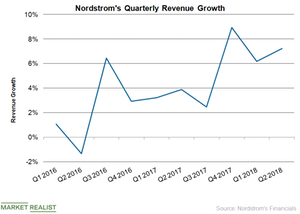

Nordstrom’s (JWN) revenue grew 6.7% to $7.6 billion in the first half of fiscal 2018. In the second quarter, which ended on August 4, the company’s revenue grew 7.2% on a year-over-year basis to $4.1 billion.

Sept. 10 2018, Updated 12:35 p.m. ET

Strong performance so far

Nordstrom’s (JWN) revenue grew 6.7% to $7.6 billion in the first half of fiscal 2018. In the second quarter, which ended on August 4, the company’s revenue grew 7.2% on a year-over-year basis to $4.1 billion. Revenue came in ahead of analysts’ expectation by 2.8%. Nordstrom’s fiscal second-quarter revenue growth was higher than its 3.9% growth in the second quarter of fiscal 2017 and 6.2% growth in the first quarter of fiscal 2018.

Nordstrom’s revenue comprises its retail net sales and credit card revenue. In the fiscal second quarter, the company’s net retail sales grew 7.1% to $3.98 billion, and its credit card revenue was up 14.5% to $87 million.

Comparison with peers

Nordstrom’s net fiscal second-quarter sales growth was higher than its peers’ in the department store space. Net sales for Macy’s (M) and JCPenney (JCP) declined 1.1% and 7.5%, respectively. On the other hand, Kohl’s (KSS) net sales grew 3.9%, driven by strength in the company’s stores as well as its digital channels.

More on second-quarter top-line growth

Nordstrom’s net sales growth in the fiscal second quarter included a 100-basis-point favorable impact from a shift in its calendar and the adoption of a new revenue recognition standard. However, the company expects these favorable factors to reverse and adversely impact fiscal third-quarter sales.

Nordstrom’s same-store sales grew 4% in the fiscal second quarter, driven by growth across both its full-line and off-price businesses. Same-store sales for the full-price business rose 4.1%, with strength in the kids’ apparel and beauty categories. Same-store sales for the off-price Nordstrom Rack business grew 4.0% in the fiscal second quarter. Shoes were the top-performing category in the off-price business.

Nordstrom’s online sales grew 23% in the fiscal second quarter and accounted for 34% of overall sales, compared to 29% in the second quarter of fiscal 2017.

Currently, analysts expect Nordstrom’s overall revenue to rise 1.8% to $3.7 billion in the third quarter of fiscal 2018. We’ll discuss Nordstrom’s revenue guidance for fiscal 2018 in Part 5 of this series.