TJX Companies and Ross Stores: Assessing Store Growth Plans

While several retailers and department stores are closing down stores amid intense competition from online retailers, off-price retailers TJX Companies and Ross Stores (ROST) see a tremendous opportunity to grow their store base.

April 30 2019, Published 8:26 a.m. ET

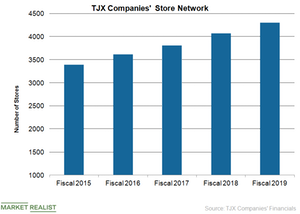

TJX Companies’ store network

TJX Companies (TJX) opened 236 net new stores (net figure takes into account stores closed) globally in fiscal 2019, which ended on February 2. As of the end of fiscal 2019, the off-price retailer operated 4,306 stores including 3,143 stores in the US, 484 stores in Canada, 635 stores in Europe, and 44 stores in Australia.

While several retailers and department stores are closing down stores amid intense competition from online retailers, off-price retailers TJX Companies and Ross Stores (ROST) see a tremendous opportunity to grow their store base.

Ross Stores opened 75 Ross Dress for Less stores and 24 dd’s DISCOUNTS stores in fiscal 2018, which ended on February 2. The company closed four Ross Dress for Less stores in fiscal 2018. As of the end of fiscal 2018, Ross Stores operated 1,717 stores, including 1,480 Ross Dress for Less stores and 237 dd’s DISCOUNTS stores. Ross Stores does not have an international presence unlike its larger rival TJX Companies.

Significant growth opportunity

TJX Companies aims to add about 230 net new stores in fiscal 2020, which ends on February 1, 2020. In the US, the company plans to add about 60 stores in its Marmaxx division (which includes T.J. Maxx and Marshalls stores), 65 HomeGoods stores, and 15 HomeSense stores. TJX Companies also plans to open up to ten Sierra stores.

The company’s international store growth plans in fiscal 2020 include the opening of 30 new stores in Canada, about 40 stores in Europe, and ten stores in Australia.

Ross Stores plans to open 75 Ross Dress for Less stores and 25 dd’s DISCOUNTS stores in its fiscal 2019, which ends on February 1, 2020. Over the long term, TJX Companies sees the opportunity to operate 6,100 stores, while Ross Stores targets 3,000 stores.