Analysts Expect Costco to Sustain Sales Growth Momentum in 2019

Costco (COST) impressed investors with its sales growth rate in fiscal 2018.

Dec. 4 2020, Updated 10:42 a.m. ET

Analysts’ expectation

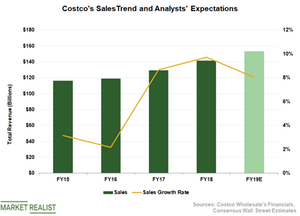

Costco (COST) impressed investors with its sales growth rate in fiscal 2018. The company has surpassed analysts’ sales expectations in the past seven quarters. Meanwhile, its top line has increased at an average rate of 10.7% in the past seven quarters, which is phenomenal, as the company faces increased competition in the grocery business. Costco continues to generate industry-leading comps thanks to the higher traffic and rise in average ticket size.

Wall Street analysts expect Costco to sustain its strong sales growth momentum in fiscal 2019 and outperform both Target (TGT) and Walmart (WMT) with its sales growth rate. Analysts expect Costco’s top line to increase by 8.0% in fiscal 2019, which is higher than the projected growth rate of 4.8% and 2.8% for Target and Walmart, respectively.

Factors behind Costco’s impressive sales

Costco’s stellar sales growth is led by the company’s strong comps, reflecting higher traffic and increased ticket size. The company’s investment in price to widen the value gap with peers and expanded offerings are driving traffic. Meanwhile, Costco’s membership renewal rate remains high at 90.5% at the end of the first quarter of fiscal 2019 in the US and Canada, which is an encouraging sign.

In comparison, the sales growth rate of both Walmart and Target are expected to remain below Costco’s. However, both these retailers are expected to continue to benefit from higher consumer spending. Also, their expended e-commerce offerings and focus on merchandising are likely to drive comps.