AMD Progresses towards Target Capital Structure

Three years back, Advanced Micro Devices (AMD) was grappling with multiple years of losses, which led to negative cash flow.

Nov. 20 2020, Updated 11:54 a.m. ET

AMD’s capital structure

Three years back, Advanced Micro Devices (AMD) was grappling with multiple years of losses, which led to negative cash flow. These losses strapped the company’s cash and resulted in a huge amount of debt. The company was competing with cash-rich rivals Intel (INTC) and NVIDIA (NVDA), which enjoyed strong profits and cash flows. In order to compete better with its rivals, AMD aims to strengthen its balance sheet and stabilize its cash flows.

After three years of strong product implementation, AMD managed to turn its losses to profits in 2018. The company is on track to achieve its long-term profit targets by increasing the mix of its higher margin Ryzen, Radeon, and EPYC processors in 2019 and beyond. The company has also been working on improving its capital structure and achieved some degree of success.

Cash flow

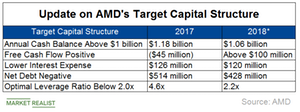

AMD aims to become FCF (free cash flow) positive. The company achieved a break-even point in 2017, but its capital expenditure resulted in a negative FCF. It aims to achieve higher cash flows in 2018, which could pay for its capital expenditure and improve FCF to more than $100 million. It expects to maintain this positive FCF in 2019 and beyond.

Cash and leverage

AMD’s target was to maintain its cash reserve above $1 billion, and it achieved this target in 2017. After achieving its targeted cash reserve, the company aimed to spend excess cash to repay debt. Implementing on its plans, the company reduced its debt by $111 million to $1.59 billion in the first three quarters of 2018. We expect the company to reduce its debt by another $100 million in the fourth quarter of 2018, resulting in net debt of $428 million at the end of 2018. The company aims to reduce its debt below $1 billion and turn net debt negative.

AMD aims to achieve a leverage ratio (debt-to-EBITDA) of below 2.0x. It reduced its leverage ratio from 4.6x in the fourth quarter of 2017 to 2.2x in the third quarter of 2018 by increasing its EBITDA and reducing its debt. The company will likely continue to reduce its debt this year and might even achieve its targeted leverage by the end of the year.

Strong earnings in 2019 might encourage AMD to revise its long-term financial model. We’ll look into this next.

Check out all the data we have added to our quote pages. Now you can get a valuation snapshot, earnings and revenue estimates, and historical data as well as dividend info. Take a look!