Zejula Is a Major Growth Driver for Tesaro

In its third-quarter earnings conference call, Tesaro (TSRO) has forecasted Zejula’s revenues for fiscal 2018 to fall in the range of $233 million to $238 million.

Dec. 11 2018, Updated 1:40 p.m. ET

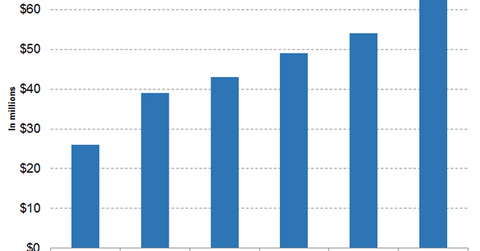

Zejula revenue trends

In its third-quarter earnings conference call, Tesaro (TSRO) has forecasted Zejula’s revenues for fiscal 2018 to fall in the range of $233 million to $238 million. The company has forecasted the drug’s net sales to fall in the range of $67 million and $72 million. As per the company’s third-quarter earnings conference call, Tesaro expects its other revenues, which include sales of the Varuby oral formulation and licensing revenues, to fall in the range of $25 million and $27 million for fiscal 2018. In the first nine months of 2018, Zejula’s global sales were $166 million.

The above diagram highlights the revenue growth trajectory of Tesaro since Q2 2017. In the third quarter, Zejula reported sales of $63 million, which is a YoY rise of 142.31% and a sequential rise of 16.67%.

Approved indication

On March 27, 2017, Tesaro issued a press release announcing FDA approval of PARP inhibitor Zejula as maintenance therapy for recurrent ovarian cancer patients, irrespective of their BRCA mutation status.

As per Tesaro’s third-quarter earnings conference call, around 10,000 patients, most of which are ovarian cancer patients, have used Zejula since its launch in the US and European markets. As per the company’s third-quarter earnings conference call, Zejula also accounts for a 40% to 50% share of the total ovarian cancer patients treated with PARP inhibitors in the US and even more than a 50% share of the recurrent ovarian cancer patients treated with PARP inhibitors in the maintenance setting.

As per the company’s third-quarter earnings conference call, Zejula also witnessed robust adoption in international markets such as Germany, the United Kingdom, and other European markets, as maintenance therapy in the recurrent ovarian cancer indication.

In the next article, we’ll discuss the geographic market performance of Zejula in greater detail.