What Drove Nike’s Fiscal 2019 Second-Quarter Revenue

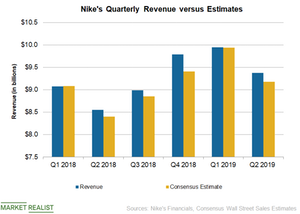

In the second quarter of fiscal 2019, Nike’s (NKE) revenue rose ~10% YoY (year-over-year) to $9.37 billion.

Dec. 26 2018, Updated 11:25 a.m. ET

Revenue beats estimates

In the second quarter of fiscal 2019, Nike’s (NKE) revenue rose ~10% YoY (year-over-year) to $9.37 billion. It beat analysts’ consensus estimate, driven by Nike’s international and Nike Direct operations. Revenue increased rose 26% YoY in Greater China, 9% YoY in North America, 8% YoY in Europe, the Middle East, and Africa, and 2% in the Asia-Pacific region and Latin America.

Nike Digital revenue, of which the mobile channel comprises over half, rose 41% on a currency-neutral basis. Nike-brand footwear and apparel revenue rose 11% and 10%, respectively, while equipment revenue fell 1%. Converse sales rose 4% YoY.

Nike, focused on enhancing its digital operations, is confident that its digital penetration will increase to 30% by 2023 from its current 15%. In Nike’s second-quarter conference call, management stated that Chinese and other international markets could continue to grow as sports culture expands.

Outlook

As we’ve discussed, Nike expects its fiscal 2019 revenue growth (on a currency-neutral basis) to be stronger than previously expected. In the third quarter, Nike expects currency-neutral revenue growth in the high-single-digit range. However, foreign exchange volatility could keep its real-dollar revenue growth under pressure.

Expectations for other athletic apparel retailers

In the fourth quarter of fiscal 2018, analysts expect Under Armour’s (UAA) revenue to rise by 1.2% YoY to $1.38 billion, driven by higher wholesale and international sales. They expect Skechers’s (SKX) revenue to grow 13.5% YoY to $1.10 billion, helped by its wholesale and retail business boosting its top line.