Strong Intermodal Growth Drove CSX’s Rail Traffic Higher

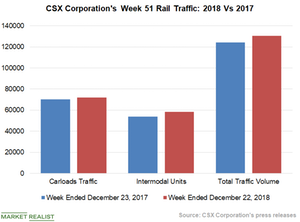

CSX reported strong rail traffic volume growth in week 51. The company’s freight rail traffic increased 5.1% YoY to 130,542 units in week 51.

Jan. 1 2019, Updated 9:00 a.m. ET

Intermodal traffic increased

CSX (CSX) reported strong rail traffic volume growth in week 51. The company’s freight rail traffic increased 5.1% YoY (year-over-year) to 130,542 units in week 51 due to strong growth in intermodal units.

CSX’s intermodal traffic grew 8.5% in week 51 to 58,513 containers and trailers from 55,933 units in week 51 of 2017. The company’s container traffic increased 8.4% YoY to 55,563 units in week 51 from 51,248 units in the same week last year. CSX’s trailer volumes grew 9.9% YoY to 2,950 units from 2,685 units. In the first 51 weeks, CSX’s intermodal traffic growth was 2.2% YoY—much lower than US railroad companies’ 5.5% YoY gain during the same period.

The company’s YoY intermodal traffic gains remained in third place among all of the Class I railroad companies (FTXR) during week 51. Union Pacific (UNP) and Kansas City Southern (KSU) were ranked first and second with intermodal volume gains of 12.3% and 8.6%, respectively. Canadian Pacific (CP) was the only Class I railroad company that registered a YoY decline in intermodal units. Canada’s second-largest freight railroad company reported a 1.5% YoY fall in intermodal traffic.

Carload traffic improved

CSX posted 2.5% YoY carload traffic growth in week 51. The company carried 72,029 railcars, excluding intermodal units, in the week—compared to 70,284 units in week 51 of 2017. Compared to US rail carriers’ 3.1% carload gain, CSX’s carload traffic saw much lower gains during the week.

CSX’s carloads of commodity groups, except coal and coke, accounted for 74% of its total carload traffic in week 51. CSX’s coal and coke traffic made up the remaining 26% of its total carloads. Traffic of commodity groups, excluding coal and coke, grew 3.6% YoY in week 51 to 53,242 railcars from 51,387 railcars. Coal and coke traffic fell 0.6% YoY to 18,787 wagons from 18,897 wagons.

Commodity groups, excluding coal and coke, that reported notable volume growth in week 51 included grain, farm products, petroleum and petroleum products, metal products, iron and steel scrap, and motor vehicles and parts. The commodity groups that recorded a YoY decline in the volumes in week 51 included food products, chemicals, non-metallic minerals, and metallic ores.

Next, we’ll discuss Norfolk Southern’s rail traffic performance.