What Drove Fortinet Stock Lower on November 2?

Fortinet (FTNT) fell 13.3% on November 2 to close at $72.56.

Aug. 18 2020, Updated 6:27 a.m. ET

Stock declined over 13%

Fortinet (FTNT) fell 13.3% on November 2 to close at $72.56. The stock though has still gained 66% this year and 85% in the trailing-12-month period. Peer companies such as Palo Alto Networks (PANW), Checkpoint (CHKP), Symantec (SYMC), and FireEye (FEYE) have generated returns of 27%, 7%, -30%, and 31%, respectively, this year.

Fortinet announced its third-quarter results last week and reported revenue of $454 million, a rise of 21% year-over-year and above analyst estimates of $451 million. Earnings per share rose 75% to $0.49, which were well above estimates of $0.42. The company also expects revenue of $495 million in the fourth quarter, a rise of 19% year-over-year with earnings expected to rise 60% to $0.51.

In comparison, analysts expect revenue of $467 million with earnings of $0.50 in the fourth quarter.

So what drove Fortinet stock lower?

Fortinet beat estimates in the third quarter, and guidance for the fourth quarter was above expectations. However, the stock corrected significantly. The correction might be due to profit booking by investors. It might also be a case of overvaluation that resulted in a price drop.

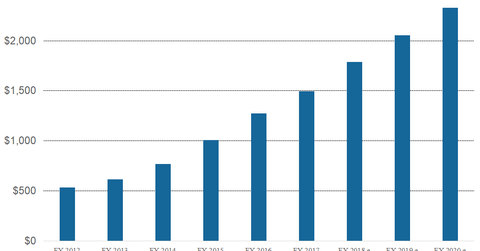

Fortinet’s revenue is expected to rise 19.3% to $1.78 billion in 2018 and 14.3% to $2.04 billion in 2019. Sales are expected to rise by 13.4% to $2.32 billion in 2020 as well. The earnings per share are expected to rise by 60.6% in 2018, 16.2% in 2019, and at a CAGR (compound annual growth rate) of 26% over the next five years.

Given Fortinet’s forward 2018 PE ration of 61.8x and 2019 ratio of 70.4x, it seems that impressive sales and earnings were not able to support these high valuations.

However, Fortinet is part of a high growth business segment. Out of the 30 analysts covering Fortinet, 21 recommend a “buy,” seven recommend a “hold,” and two recommend a “sell” on the stock. Analysts have an average 12-month stock target of $79 for Fortinet, indicating upside potential of 8.8%.