General Electric’s Renewable Energy Business

On September 24, General Electric’s (GE) Renewable Energy division launched its new onshore turbine platform named “Cypress.”

Sept. 26 2018, Updated 9:02 a.m. ET

General Electric’s new turbine platform

On September 24, General Electric’s (GE) Renewable Energy division launched its new onshore turbine platform named “Cypress.” Along with the platform, the company also launched the next model from that platform—the 5.3-158 turbine. The platform transforms the technology of General Electric’s 2 MW and 3 MW fleets. These fleets serve an installed base of ~20 GW.

Cypress, the new onshore turbine platform, enables substantial AEP (annual energy production) improvements. According to General Electric, the platform also helps increase the efficiency in serviceability and improves logistics and the siting potential. The Cypress platform will be powered by a new two-piece blade design that would increase the blade’s length. Longer blades improve AEP and lower the levelized cost of electricity.

Haliade wind turbine

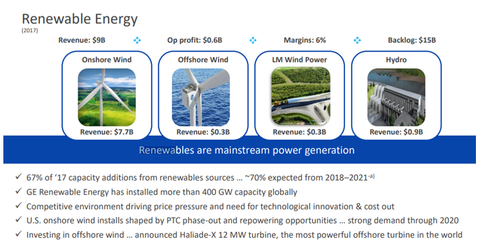

On September 14, General Electric’s Renewable Energy division announced the completion of the Haliade wind turbine installation. The company installed the latest Haliade 150-6 MW offshore wind turbine on the 396 MW Merkur offshore wind farm in Germany.

In June 2015, Merkur Offshore selected GE Renewable Energy to supply 66 Haliade TM 150-6 MW offshore wind turbines. Merkur also signed a ten-year global operating and maintenance service contract with GE Renewable Energy. Merkur’s offshore wind farm is poised to become one of the largest offshore wind farms in Germany. The wind farm is expected to generate ~1,750 GWh of power annually, which would provide electricity to 500,000 homes.

XLI

In order to invest directly in industrial sector stocks, you could consider investing in the Industrial Select Sector SPDR Fund (XLI). XLI has 8.35% weight on Boeing (BA), 5.24% on 3M (MMM), and 5.12% on Honeywell International (HON). XLI has a 4.26% weight on General Electric.

Next, we’ll discuss the developments at GE Digital.