A Closer Look at Square’s Marketing Spending

In the third quarter of 2018, Square spent 15.4% of its revenue on product development and 13.2% on sales and marketing activities.

Jan. 29 2019, Updated 7:30 a.m. ET

Over 13% of revenue spent on marketing

Product development and marketing have generally been two prominent cost items at Square (SQ). In the third quarter of 2018, Square spent 15.4% of its revenue on product development and 13.2% on sales and marketing activities.

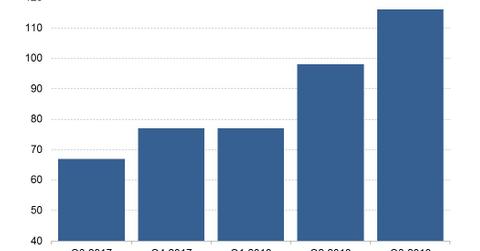

Over the last three quarters, Square has allocated an increasing portion of its revenue toward marketing activities. Its marketing budget made up 12% of its revenue in the second quarter of 2018 and 11.5% of its revenue in the first quarter.

Marketing allocations at Square’s peers

At PayPal (PYPL) and Alphabet, marketing spending represented 17.3% and 26.7% of revenue, respectively, in the third quarter. OnDeck Capital (ONDK) and Facebook (FB) spent 10.5% and 13.9% of their revenues on marketing activities, respectively, in the quarter. Amazon’s (AMZN) revenue represented 5.8% of its marketing budget in the quarter.

Increase in advertising costs drove marketing spending

At $116 million in the third quarter of 2018, Square’s marketing budget rose 75% YoY (year-over-year). The rise in Square’s marketing budget was driven by an increase in its advertising expenditure—especially for its Cash App product—and increasing sales costs. Through Cash App, Square offers a variety of services, such as peer-to-peer money transfer and Bitcoin trading. Square also issues a debit card linked to the Cash App that allows users to withdraw their funds from ATMs.