Factor: Credit Exposure

Another common factor in fixed-income investing is credit exposure because investing in securities with an element of credit risk has historically generated positive risk premiums over time.

Nov. 21 2017, Published 2:16 p.m. ET

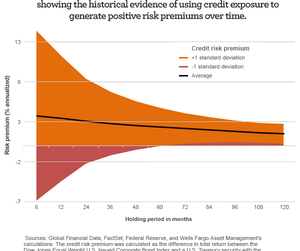

Another common factor in fixed-income investing is credit exposure because investing in securities with an element of credit risk has historically generated positive risk premiums over time. For example, U.S. Treasuries are assumed to have minimal default risk and therefore, as a less risky asset, have no credit premium. At the other end of the spectrum, high-yield bonds have greater credit risk and therefore command a significant yield advantage over Treasuries, known as the credit spread. The credit risk premium depends on the initial level of the credit spread and the economic environment that prevails during the holding period. Historical data shows that the credit risk premium tends to decline as the holding period lengthens but its standard deviation begins to stabilize after a fairly short holding period, providing a sense of what a reasonable investment horizon may be for benefiting from credit exposure.

A second consequence of the typically longer-term investment horizon of target date investors is that their time horizon allows them to be compensated for credit risk and therefore credit exposure might be an important source of return. Investment-grade corporate bonds usually provide income beyond what Treasury securities can, often with less duration risk. High-yield bonds usually provide additional income with more diversification benefits as they are even less correlated with Treasuries than investment-grade corporates.

Factor: Inflation sensitivity

Different securities behave differently depending on the inflation environment, and this is an especially important consideration for target-date investors. Those who are working can typically expect raises in their paychecks to compensate for increases in inflation. Since 1983, according to the Federal Reserve Bank of Atlanta’s Wage Growth Tracker, which measures wage growth of those continuously employed, wages grew—on average—1.3% faster than inflation as measured by year-over-year changes in the Consumer Price Index. Only 11% of the time did the average wages of those continuously employed fail to keep up with inflation. As a result, getting exposure to investments with positive inflation sensitivity may be an important consideration for those approaching retirement and those in retirement.

Many fixed-income securities, especially shorter-term corporate debt, have attractive inflation sensitivity where the returns can more than compensate for inflation. However, there are two additional considerations for target date investors. First the sub-asset classes performed differently depending on the point in the business cycle due to credit risk. Second, because many fixed-income investments are highly correlated with each other, it may be important to consider which asset classes have low correlations to other assets in the portfolio in an attempt to diversify the set of inflation-sensitive assets.

Inflation-sensitive sectors most notably include TIPS, which can specifically target mitigating inflation risk. Another inflation-sensitive sector—emerging markets bonds—not only have a historical record of beating inflation and generating income, they also have additional diversification properties U.S. fixed income instruments do not. By having returns that are often driven by macroeconomic forces unique to emerging markets, they attempt to provide macroeconomic diversification for an otherwise all U.S.-based portfolio. However, they also have significant credit risk, meaning that they should not just be tacked onto a portfolio that already has credit risk exposure.