39% of Analysts Rate AMD Stock as a ‘Buy’ after Q3 Earnings

Despite a weak third quarter, 12 of the 31 analysts covering Advanced Micro Devices (AMD) rated the stock as a “buy.”

Aug. 18 2020, Updated 6:24 a.m. ET

AMD’s stock recommendations

Advanced Micro Devices (AMD) posted disappointing third-quarter earnings on October 24. The semiconductor company expects to report soft fourth-quarter revenue growth due to weakness in its semi-custom sales.

However, AMD expects its graphics sales to improve sequentially in the fourth quarter due to new data center GPU products. AMD expects its 2018 revenues to increase in the mid-20.0% range on a year-over-year basis.

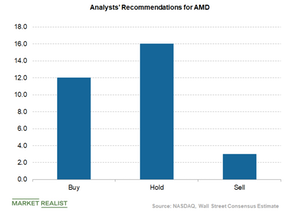

Despite a weak third quarter, 12 of the 31 analysts covering Advanced Micro Devices (AMD) rated the stock as a “buy.” Sixteen analysts rated the stock as a “hold,” and three analysts gave the stock a “sell” rating.

Analysts set a target price of $24.13 for AMD stock and gave a median consensus estimate of $25.00. AMD is trading at a 22.9% discount to its consensus median target estimate.

AMD’s growth drivers

During the third quarter, AMD’s total client revenues increased more than 70.0%, driven by accelerated sales of Ryzen desktop and mobile processors. These sales were supported by higher demand for Ryzen 7, Ryzen 5, and Ryzen Threadripper processors.

During the quarter, AMD launched its 2nd Generation Ryzen Threadripper processors. The company also announced its first Zen core–based Athlon and Athlon PRO desktop processors. AMD also launched the Radeon Pro WX 8200 graphics card and its Vega architecture–based Radeon Pro V340 graphics card.

AMD is currently on track to launch its 7nm (nanometer) Vega GPU later this year, which was initially intended to launch in 2019. AMD’s launch is expected to dent Intel’s (INTC) market share, which is already facing supply shortages related to its 10nm processor chips. Intel’s supply issues could directly impact DRAM makers such as Micron (MU), denting PC DRAM sales and DRAM prices.

The superior performance of AMD’s EPYC processors in the third quarter added new end customers. OEMs[1. original equipment manufacturers] such as Cisco Systems and Dell, as well as cloud service providers Microsoft (MSFT) and Oracle (ORCL), have announced new products and solutions powered by the EPYC processor.