Square’s Considering Bank-Like Options on Its Cash App

Square’s (SQ) peer-to-peer payment app is beginning to look like a bank account.

Sept. 6 2019, Updated 6:18 p.m. ET

Square’s Cash App increasingly looks like a bank

Square’s (SQ) peer-to-peer payment app is beginning to look like a bank account. It’s considering several ideas such as saving products and a way to let customers purchase stocks on its Cash App, according to what CFO Sarah Friar said at Recode’s annual Code Commerce.

Friar said, “Anything you do today with a bank account, you should look to the Cash App to begin to emulate more and more of that.”

The payments company says it’s trying to tap 30 million unbanked households in the United States through its Cash App.

Cash App has seen tremendous growth

Friar said that while the company is only thinking about it, the amount of money in users’ accounts on Cash App made it consider these ideas.

Square is better known for its card processor and payment hardware. However, its peer-to-peer payment app has seen robust growth, much like PayPal’s (PYPL) Venmo app.

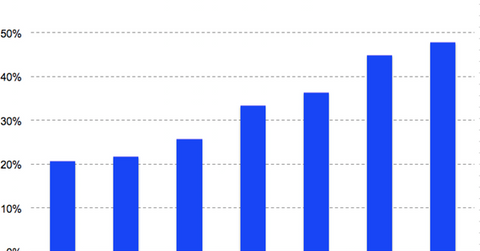

Square’s revenue growth has been accelerating lately, as the graph above shows. Its net revenue grew 47.8% year-over-year in the second quarter to $814.9 billion.

Square posted the smallest loss since going public three years ago. Its net loss came in at $5.91 million in the second quarter. The stock is up 138% year-to-date.