Do Analysts Expect JCPenney’s Revenue to Improve in 2019?

Currently, analysts expect JCPenney’s revenue to decline in fiscal 2019.

March 15 2019, Published 8:17 a.m. ET

Dismal sales in fiscal 2018

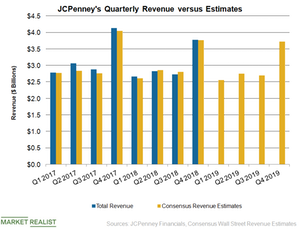

JCPenney’s (JCP) revenue (net sales and credit income) declined 8.4% to $3.79 billion in the fiscal 2018 fourth quarter but stayed ahead of analysts’ expectation of $3.78 billion. The company’s net sales fell 9.5% to $3.67 billion due to the impact of store closures and a 4.0% decline in same-store sales on a shifted basis. JCPenney failed to revive its sales in the crucial holiday season.

Categories that performed well in the quarter included jewelry, women’s apparel, kid’s apparel, and men’s clothing. For full-year fiscal 2018, JCPenney’s revenue declined 6.6% to $12.0 billion, as a 7.1% fall in net sales to $11.6 billion was partially offset by an 11.3% rise in credit income and other revenue to $355 million. JCPenney’s same-store sales declined 3.1% in fiscal 2018, which marked a deterioration compared to a 0.1% rise in same-store sales in fiscal 2017.

In fiscal 2018, JCPenney lagged peers Macy’s (M) and Kohl’s (KSS), which reported same-store sales growth of 2.0% (on an owned plus licensed basis) and 1.7%, respectively.

Sales expectations

Currently, analysts expect JCPenney’s revenue to decline in fiscal 2019, but the rate of decline is estimated to be lower compared to fiscal 2018. For full-year fiscal 2019, analysts forecast a 2.1% decline in JCPenney’s revenue to $11.8 billion.

Analysts expect JCPenney’s revenue to decline by 4.1%, 2.8%, 1.2%, and 1.4%, in the first, second, third, and fourth quarters of fiscal 2019, respectively. Intense rivalry in the retail market, especially from online retailers, is expected to put pressure on the company’s performance.

Efforts to improve sales

JCPenney is focusing on reviving its women’s apparel business. Within women’s apparel, the company is paying attention to outerwear, activewear, and dresses. JCPenney has enhanced its collaboration with Nike (NKE), Adidas, Champion, and Puma to boost its activewear sales.

Special sizes also represent a key category for JCPenney. In fiscal 2018, the company partnered with NBA legend Shaquille O’Neal to launch Shaquille O’Neal XLG in 350 stores and on its e-commerce site.

JCPenney is also growing its presence in the toys and baby clothing as well as baby merchandise categories to capitalize on the closure of stores of retailers like Toys R Us.

The next part of this series will discuss JCPenney’s profitability.